Week 16 Advance Trading Notes

Summary

I felt that the markets got fearful last Friday when they started up in the morning trading based on the strength in banks earnings but then gave up those gains by the end of the day. And despite some strength at the close, there are indications of nervousness in the market. As a starting point for the week, I am positioned short the equity markets and long the precious metals.

Long positions: GLD, SLV, GDX, GDXU, VIX (as a hedge)

Short positions: KRE, XLRE, IWM, SPY, QQQ

Potential new trade: XRT short

Major Markets

This is the week when the earnings season will start in earnest. We got a taste of it last Friday when some of the big banks reported. And the reports were quite strong with the strength reflected in their price action.

The major markets have near perfect trending. But I am positioned against the trend as of now. I am in the camp that the markets are priced for perfection which we are not going to get from the earnings reports.

I am positioned short the markets and hold a mid-level short position in the IWM and small level short positions in SPY and QQQ.

Banks

The strength in the big banks was not enough to lift up the markets Friday as they closed in the red. Overall, the markets were up for the week. This positive return (although very small) was surprising given that the pundits and experts are calling for a recession (mostly an earnings recession) coming soon.

There is a sense that the strength in the big banks will not be replicated by the regional and mid-size banks that report this week. In essence we can expect a big divergence in their stock price movement. This divergence is already evident in the trending of KBE and KRE.

I believe it makes sense to continue to play the KRE to the downside. Accordingly, I am short KRE using put options.

Commodities

The precious metals had a bad Friday. But that was after a nice runup before that. I covered in more detail here.

I continue to hold my long positions in precious metals through GLD, SLV and GDX call options.

Technology

This has clearly been the strongest sector this year so far. The returns have been akin to yearly returns in good years. However, this is probably also the sector most priced to perfection where any negative commentary from the earnings reports and calls can break the bubble.

I covered the technology sector trending and performance for last week here. I have already played the XLK and SMH for the downside with some reasonable success in the recent past. I have also played the KWEB to the upside in the recent past. However, the current trending is not good. As of now I am only short the QQQ covered above.

Global Markets

I covered Global Markets trending and performance here. I have traded FXI to the upside in the recent past but do not see anything tradable for this week.

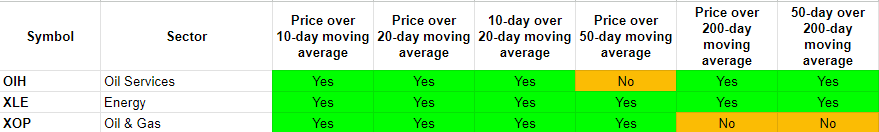

Energy

I have used these 3 ETFs for trading, and they continue to look good.

I got out of my XLE long position when the markets started going down Friday. The price of oil has been rising and does not look like it is going down any time soon. I will continue to look for opportunities to trade the above instruments - primarily XLE and XOP.

Sectors

I did a detailed assessment of the 11 SPX Sectors recently. There are strong sectors and there are weak sectors. Given my general bias for the markets to go down in the near term, I have focused on the weak sectors.

The XLRE continues to remain weak, and I continue to remain short the XLRE using put options. I am also watching XRT and will likely go short that one as well. It is as bad as the XLRE.

Stay tuned for updates.