Week 15 Major Markets Trending and Performance

It was not a good week for me as I have been positioned mostly short the equity markets. I have hedged that with long positions in the precious metals. So net result is not too bad. But still a down week for me.

I will review how the markets look like as of now and how to position for the next week.

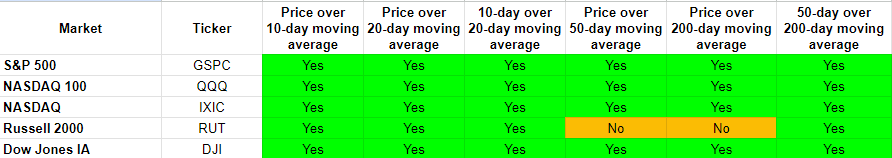

Trending Heat Map

The good has got better and the not so good has got good. The Russell 2000 has been the laggard but seems to be picking up or at least maintaining the trending to the upside. The market has been very resilient despite negative commentary from experts in written and spoken form. Perhaps some of that commentary has influenced me and I need to be more wary of that.

There is talk of an earnings recession coming which in turn will drive an economic recession. While that is possible, no one knows the timing of such events. And earnings can surprise to the upside. So, instead of following the commentary I need to follow the price movements.

I already feel better getting all of the above off my chest. To be clear, the markets did go down today despite the strong earnings from the banks. So, it was not all gloom and doom for me. So, it could be a matter of timing and my positions could still end up being winners. But I definitely have been early to buy into the recession camp. That I will rectify for sure.

Performance

The above table is interesting because it tells me that April, in general, has been week so far. The trending in the above picture shows mostly green (bullish trending) primarily because of the lagging effect of the March gains. So, even though I had a bad week, my positioning may still be good for the next week.

SPX Chart

The price has closed 2 days above the downward trending line. So, it is definitely weak but seems to be hanging in there. It certainly is busy in that area, and it does seem that the risk to the downside is higher. The price is also quite above the 150-day as of now and a pullback is quite conceivable. (Note I use the 150-day as an automated line to define longer term indicators).

QQQ Chart

The upward trending channel is definitely the stronger trend to note, and the price is nicely in between that channel. That is quite bullish. There is a thin yellow trendline I have drawn touching the prior 2 highs that is downward sloping. The price is just at that level now. So, if the price breaks through that I will reverse my positioning and go on the long side.

IWM Chart

There are no questions here that the price is within that downward channel and having difficulty. There is some hope that it goes a little higher and hits up that overhead trendline. But the strength looks weak. I will likely press this more to the downside.

I will discuss all the other markets through the weekend:

SPX Sectors

Technology

Energy

Commodities

Financials

Global Markets

Alternate Sectors

So, stay tuned for a lot more to come over the weekend.