Stock Markets ROI

It is Tuesday so time for looking at ROI. As you can read from the last note, I like to review the last 6 weeks of ROI to see any trending patterns. This combined with the trending report that I write every Monday gives me a good picture of what is happening.

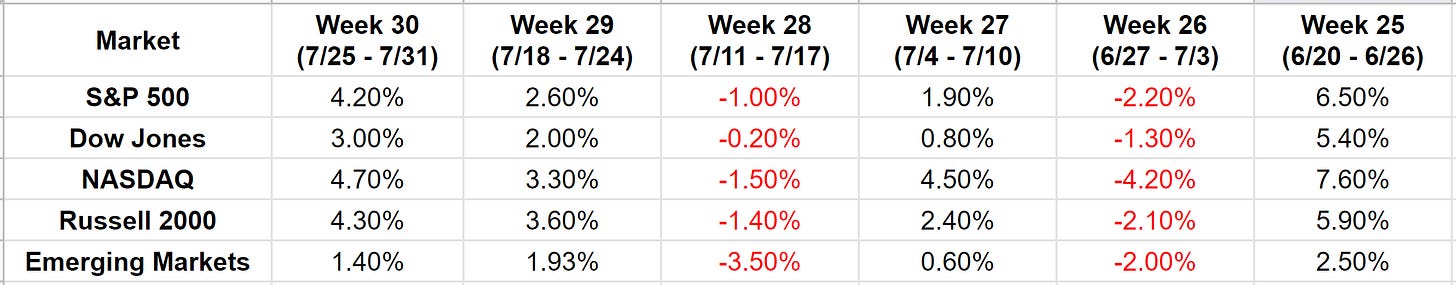

Major Markets

We can see that all the major markets bucked the trend of the last 6 weeks and delivered positive ROI 2 weeks in a row. And these were all very healthy gains. The Emerging Markets seems to still be sluggish. However, many of the Countries have started trending bullish and I expect that the Emerging Markets will start to gain some more momentum.

Major Sectors

We see similar trending in the major sectors. All of them eked out positive ROI except for the Retail sector (XRT). The Energy (XLE) and Metals/Mining (XME) sectors had the biggest gain. We saw in the trending report that both of these had again turned short-term bullish.

Observations

Markets are currently trending short-term bullish and most of the instruments that I track are staying with the market trends.

We have now had 2 weeks of positive ROI in a row and also coming off a very strong month of July.

Will the markets take a breather this week? Yesterday price action was sluggish and this morning the pre-markets are lower. So, it is possible.

Actions

My systems are still indicating a short-term bullish market. So, I will continue to trade the trend. I did buy some cheap puts to protect myself from a down week. I will likely cash them in today. I do not like to hold on to anything that is against the trend for more than a few days.