Stock Market Return on Investment

The S&P 500 is up +5% over July so far. Many are calling June 16 as the market bottom. I track the ROI (Return on Investment) trending over a few weeks to add to my trending analysis on moving indicators.

Major Markets ROI

Below are the returns on investment over the last 6 weeks for the major markets. Note that week 30 is the current week and I have included the Monday action only. I will update this table as the week progresses.

We can see that if June 16 indeed turns out to be the market low (this round of bear/bull cycle), then we did have a big week for all the markets the following week.

We have had up and down weeks in an alternating pattern so far. Week 25 was up, then week 26 was down, then week 27 was up, week 28 was down and week 29 was up. So, is week 30 (current week) going to end up being a down day?

Here is how I am looking at it. I know from the last stock market trending report, that we are in a short-term bullish trend. I also know that even though we have had alternating up and down weeks, the overall returns are positive for the month. That means the magnitude of down weeks has been lower than the magnitude of the up weeks. So, even if this week turns out to be negative, I will go with the probability that the next week more than makes up for it. That is what the trending report and the ROI report is telling me.

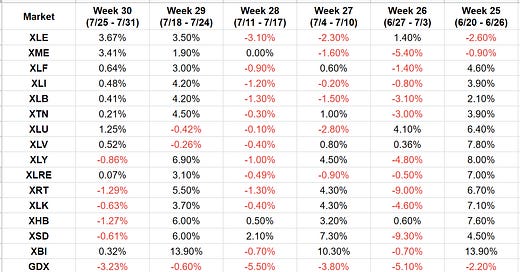

Major Sectors ROI

This is the returns on investment for the major sectors I track.

We can see a similar pattern as for the major markets. Although, we do see some sectors behaving differently. The Energy sector (XLE) and the Metals & Mining sector (XME) had big moves yesterday. Will watch if it continues higher for the rest of the week.

The Biotech sector (XBI) had a huge move up last week gaining +13.9%. It was up yesterday and, as we have seen, it is trending short-term bullish. So, will be interesting to see what it does this week. I am long XBI call options.

I am also long CURE, which is the 3x leverage of the Healthcare sector by Direxion. It was one of the first sectors to turn short-term bullish per my system. However, the ROI has not been stellar so far. I will hold for now though.

I am also long SOXL, which is the 3x leverage of the Semiconductor sector by Direxion. It had a strong move up +6% last week but closed down yesterday. It seems to be a bit more volatile than the overall markets. So, I will watch it closely.

I am also long the Financial sector through XLF call options. It has had a steady few weeks and kept pace with the overall market trends.

Conclusion

Markets may do down this week, but the up weeks have been bigger than the down weeks

Overall short-term trending remains bullish, and I will stay with the trend.