Stock Market Trending Report

Trends can change very quickly. And keeping track of short-term trends is important for my system to be successful. Twice a week I review the trends and update my trending heat map.

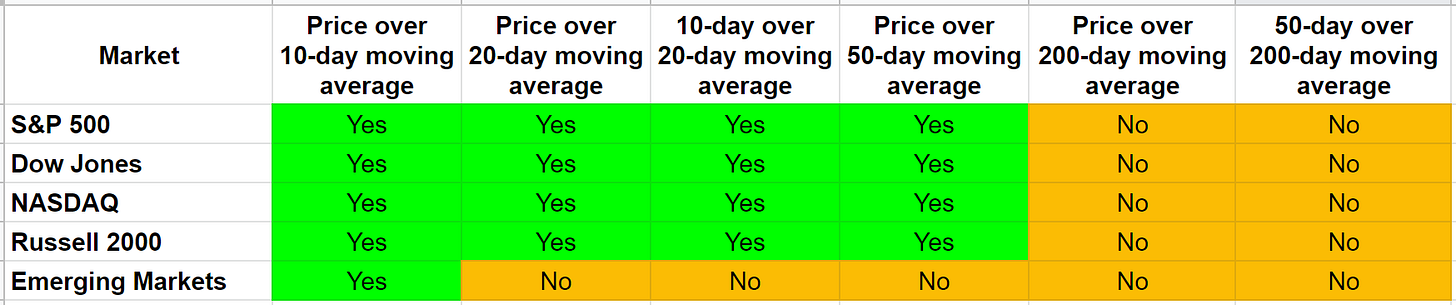

Major Markets Trending

Except for the Emerging Markets, all the major stock markets are looking good short-term. There is also a concerted effort to reverse the long-term trend from bearish to bullish as we can see from most of the price movements now taking out the 50-day moving average.

Major Sectors Trending

Several of the S&P sectors are doing well. Out of 15 sectors 9 are trending bullish. (Note I also track the GDX - Gold Miners and the QQQ - NASDAQ 100 in this trending heat map making it a total of 17 instruments that I track under major sectors). Several are also further along in that their price has crossed over the 50-day moving average. That is in sync with the overall S&P 500 as well.

Countries Trending

Outside the US, the stock markets are behaving lukewarm for now. We noticed that Emerging Markets are sluggish, and most countries are also still trying to turn short-term bullish. Interestingly, Japan just turned short-term bullish (not sure if that is because of their weak Yen). Also, Israel, Singapore and India look the strongest markets as of now.

Alternate Sectors Trending

Natural Gas is flying high and now trending short-term as well as long-term bullish. Oil is trending lower. Gold as an investment asset seems to be doing nothing. Whereas, maybe surprisingly, the crypto space led by Bitcoin and Ethereum are trending short-term bullish. Other sectors that are trending short-term bullish are Clean Energy, Robotics, Fintech and Biotech. The ARK funds that I track here are also doing well.

Big Tech Trending

We can see that Google turned short-term bearish recently (probably due to the SNAP earnings results). The Chinese stocks Alibaba and Baidu are also struggling again. Apple as expected is the most stable. Amazon, Netflix, Tesla, Nvidia and PayPal also are trending bullish short-term.

Quick Notes

I have been playing the long side on S&P 500, NASDAQ, Biotech, Healthcare, Finance and Big Tech (using FNGU).

All of them look fine to hold for now. Healthcare and Biotech may be taking a breather, so I need to watch if they are reversing again to the downside.

Semiconductors may be coming back, and I should check whether it is worthwhile to play there.