Stock Market Weekly Roundup

The major stock markets fell last week although the net fall over the week was not much. The S&P 500 and the Russell 2000 were slightly harder hit than the Dow Jones and NASDAQ. Per my model, the Dow Jones is the only index that is still trending neutral. All the other three are trending bearish.

I did market sectors review earlier this week which can be found here.

I exited all my positions earlier this week in SPXL, TECL, SOXL and DRN. All of these sectors have turned bearish. The sectors that are doing well are Energy and Financials.

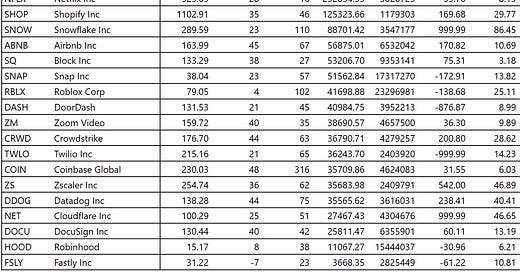

The Technology sector has been hit hard. Here are 25 stocks that I track in the sector with their fundamentals. They are sorted by market cap.

And here are their returns for 2022 so far.

They are all negative. Of course, it is very early in the year and things will turn around at some point. In fact, it is likely that they manage to beat earnings expectations through the rest of the year and stock prices rise. But they are starting from a very low point. Note that all of them except Roblox are still expected to have earnings growth of +20% in the year.

The top 5 ranked by projected earnings growth are:

TSLA +52%

COIN +48%

ABNB +45%

CRWD +44%

DDOG +44%

For folks who look at fundamentals closely, COIN seems to have the most reasonable P/E ratio of 31.55.