Big Tech - A Different View

Someone told me on twitter yesterday that the FANG+ composition has changed. Twitter has been removed and Microsoft has been added as replacement. And I just tried to go to that twitter link to realize that twitter is down. It is currently down on my laptop as well as my smartphone. Not sure if it is just for me or common to all users. Interestingly, I also realize that the way I would find out if something is down or not is by checking on twitter. Never thought of what I would do if twitter were down.

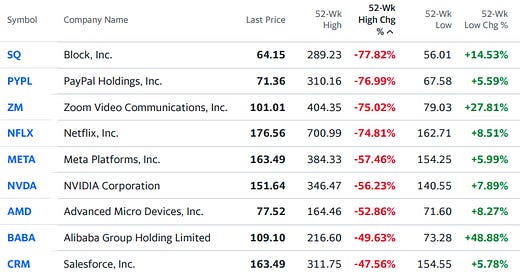

Anyway, that is not the reason for my note. Few days back I covered Big Tech by looking at their price trending. Today. I wanted to throw a different light on them. And that is, how far they have fallen from their 52-week high. Fortunately, Yahoo Finance provides this information directly. Here is the table:

The table is sorted by which stock has fallen the most from its 52-week high. The last column is how much it has come up from its 52-week low.

Most people agree that all these companies will keep generating earnings at least for the next few years (even if at a slower pace). So, naturally their stock price should bounce back. The question really is when that will happen. Folks who are into dollar cost averaging should not be worrying about timing. But folks who were investors during the dot com boom and bust cycle will remember that the bust cycle stayed for a long time. They will need to decide if they are able to hold on to their purchases from today for a long time.

For those who read my notes will know that I do not invest directly in any of the above stocks. I like to hedge my bets and play them through index offerings. Fortunately, there are couple of leveraged instruments that give exposure to a small basket of big tech stocks. These are FNGU and BULZ. I like the leveraged instruments because if I catch the right trend at the right time, the returns are usually better than holding on-to any of the underlying stocks. There is also FNGD and BERZ which are the inverse leveraged instruments for the big tech stocks.