Big Tech Trending and Performance

Today I want to review the Big Tech stocks and check their trending as well as performance. The technology sector seems to be the leader in the market so far in its attempt to reverse. I use the 18 stocks that make up the FNGU and BULZ leveraged Big Tech index. (Disclosure: I am long FNGU at this time).

Trending

Using my system for checking trending, I get the following table (my heat map).

Almost everything looks good and in reversal mode. Twitter, of course, has the Elon Musk challenge to deal with and unfortunately the situation has caused its stock price to have strange gyrations. Twitter is 10% of FNGU so it does have an impact.

Chinese stocks have been on a good run and that is reflected in the trending of Alibaba and Baidu. (Disclosure: I am long YINN at this time).

One interesting aspect of the stock market turnaround so far has been the underperformance of the Semiconductors. We can see that Nvidia, AMD, Micron and Intel have been laggards in reversing their trend.

Next, we will see the actual performance of these stocks.

Performance

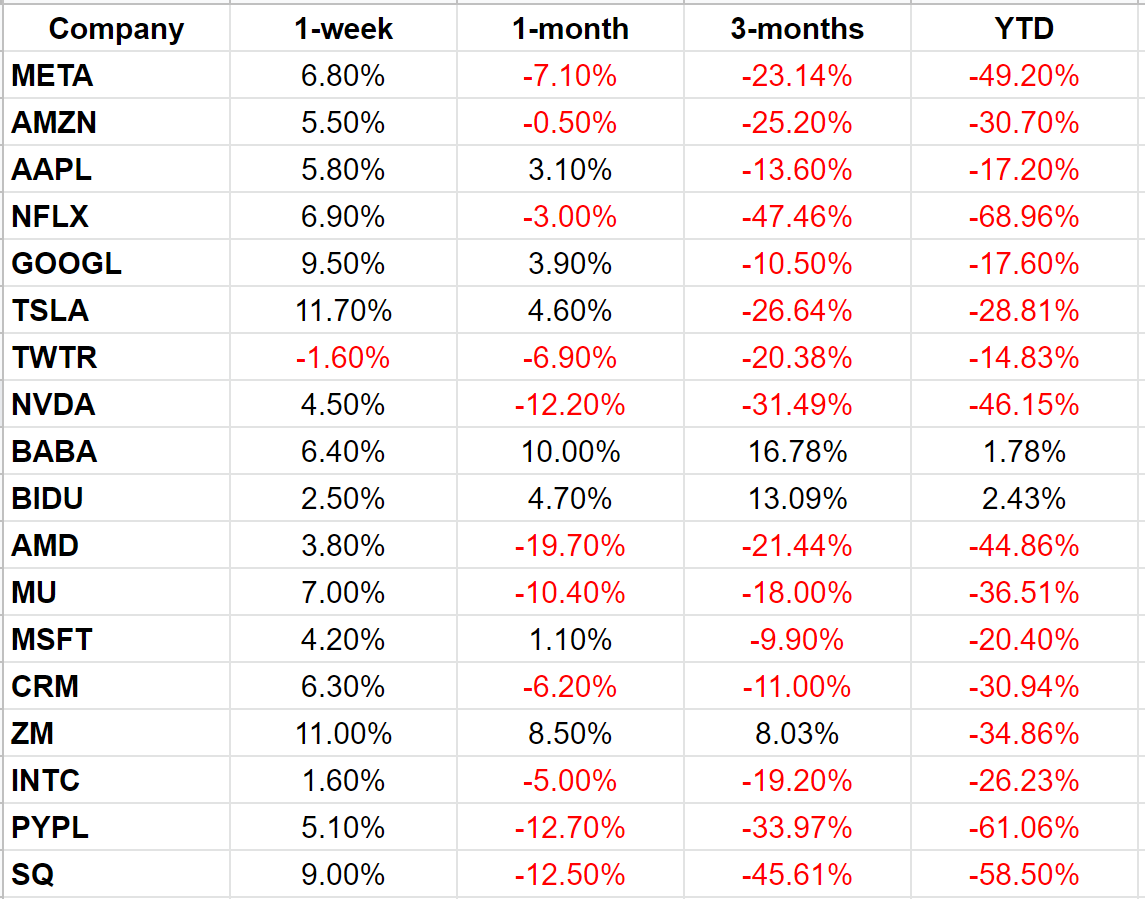

Here is the table.

The standout stars are the Chinese bellwethers of Alibaba and Baidu. That is consistent with their trending and the overall quicker reversal of the Chinese markets. We will have to see if they keep leading the markets higher.

As expected from the trending analysis earlier, the Semiconductors have had one of the worst performances this year. Their 1-week return suggests some level of turnaround, but we will have to see if that continues. More importantly if they catch-up with the rest of the market.

Conclusion

The Big Tech stocks seem to be leading the reversal of the overall markets. Most of them have turned bullish per my system. As my readers know, I do not trade on individual stocks to avoid single stock risk. I am long FNGU though and will stay long for now as the trends look good.