I wrote a note last Thursday that the risk is to the downside. I still think that is true. Although the markets were up last week again even if just by a little. Last week made it the 6th straight week that the markets were higher. That is rare although not unprecedented.

Here is how the trending looks like from the daily charts.

I call it near perfect. There was a little more deterioration at the beginning of the week. But the markets bounced back by the end of the week. The MACD read for SPY and QQQ being negative is only a little concerning. It does show some divergence where the markets are going higher whereas the momentum seems to be decreasing a bit.

The MACD is not a highly reliable indicator of things to come. There is a better than 50% chance that the SMAs follow the MACD. But I have seen the MACD keeps reversing without the SMAs reversing. So, it is an early indicator but not reliable 100% of the time.

Going back to my read that the risk is still to the downside. What that means is there is a greater than 50% chance that the market goes lower from here. That does not mean it will. It means the probability is higher that it will.

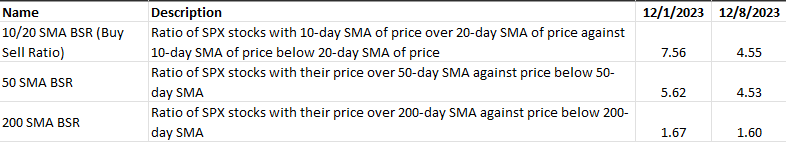

Here are some ratios that I track:

They are self-explanatory from a trending perspective. We can see that the ratios are decreasing week-over-week even though the market has gone up. This confirms what the MACD read is telling us as well.

The VIX remains very low as well. Although that does not give any good indication other than the market participants seem to be very comfortable with everything happening with the market and the market impacting conditions.

Strategy

As mentioned last Thursday I have a small, short position (25% position) and will continue to hold that for now. Whether I add to that or close the short position will depend on what the trends tell me from here.