Week 8 Major Markets Trending and Performance

Seems like the markets made the decision to go down. It was poised somewhat in an indecisive manner. Although I was positioned to the short side, the markets could have decided to go in either direction. As it turned out, all the markets weakened this week.

Trending Heat Map:

The S&P 500 turned short-term bearish, and the price also dipped below its 50-day moving average.

The NASDAQ turned short-term bearish, and its price dipped below its 200-day moving average. Note that the NASDAQ, unlike the S&P 500, had never turned bullish. So, while price is still above the 50-day moving average, it is also trending long-term bearish.

The Russell 2000 turned short-term bearish.

China price dipped below its 200-day moving average.

The EAFE index dipped below its 50-day moving average.

The EEM price dipped below its 200-day moving average.

Dow Jones no change.

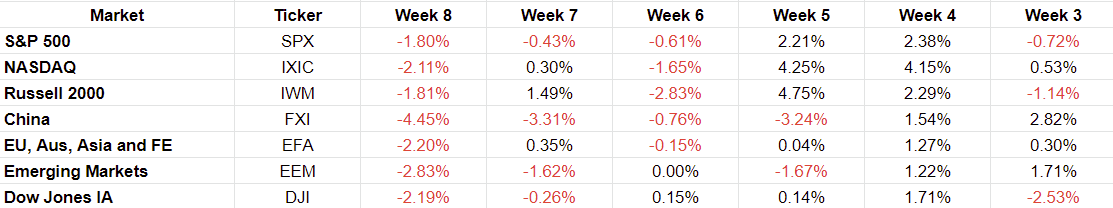

Week-over-Week Performance

Performance over various periods

Observations and Conclusions

All markets were lower, and their trending weakened. In fact, all of them are now trending short-term bearish. I do not see any catalyst to reverse the trending just yet. So, the risk remains to the downside.

While February has been bad for all the markets, all of them except China and the Dow are still up for the year. Interestingly, these were 2 of the stronger markets in the recent past and showing more weakness now.

The Emerging Markets including China are demonstrating the weakest trending and performance. These were the leaders of the recent run up in prices.

Planned Action: Continue to play the markets to the downside for now.