Week 7 Mid-Week Trending Updates

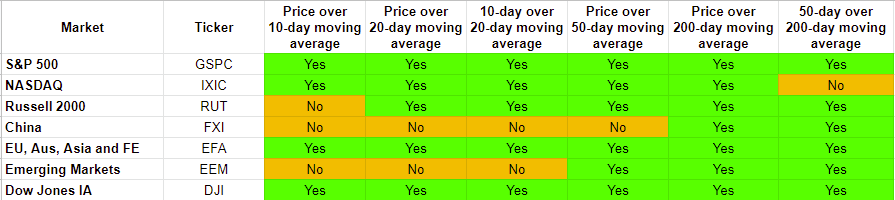

Starting with the Major Markets:

The S&P 500 is back to being perfectly bullish. The price went back over its 10-day moving average.

The NASDAQ price also crossed back over its 10-day moving average.

No change in the Russell 2000.

No change in China FXI.

The EFA price crossed back over its 10-day and 20-day moving averages. It turned back to being perfectly bullish.

No change in the Emerging Markets EEM. It stayed short-term bearish.

The Dow Jones price crossed back over its 10-day moving average. It went back to being perfectly bullish.

Now reviewing the SPX sectors:

XLY price crossed back over its 10-day moving average.

XLV price crossed back over its 10-day moving average.

XLU - no change.

XLRE price dipped below its 20-day moving average.

XLP - no change.

XLK - no change, looks the strongest.

XLI price crossed back over its 10-day moving average.

XLF price crossed back over its 10-day moving average.

XLE - no change.

XLC - no change.

XLB - no change.

Conclusion:

The volatility index being low (around 20), there is not a lot of fluctuation in the prices. However, there seems to be good amount of tension between the bulls and the bears. So, the markets could either way. I am still positioned short the market as I think there is more downside risk than upside risk at this time.