Week 6 Alternate Sectors Trending and Performance

It is best to review the changes between last week and the prior week trending by seeing both the heat maps.

Current Trending Heat Map:

Trending Heat Map from 6 weeks back:

I have added 2 more alternate sectors that I track now from what I used to track 6 weeks back.

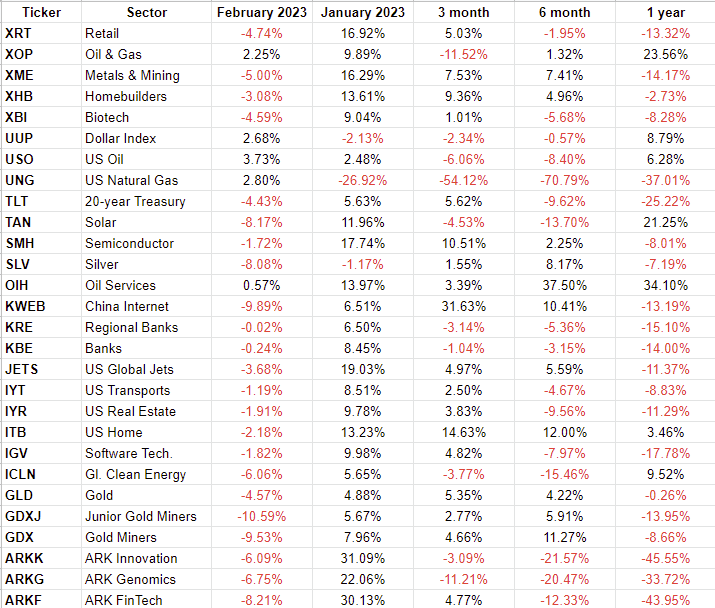

Here is the performance through various periods.

Notable Observations and Conclusions:

Month of January saw a number of sectors with “overexuberance”. The S&P 500 was up +6.6% whereas XRT, XME, XHB, TAN, SMH, OIH, JETS, ITB, ARKK, ARKG and ARKF all showing double digit percentage gains. No one should be surprised if these give back more than the S&P 500 going forward. So, if one thinks the S&P 500 goes lower from here, then one could pick a few from this list to go lower than the S&P 500.

Precious metals have certainly reversed from their bullish trending to mostly bearish trending. Silver SLV has done poorly all of this year. Gold GLD and Gold Miners GDX and GDXJ have also weakened significantly.

US Natural Gas UNG is interesting as the price has finally crossed over its 10-day moving average. That is only significant because UNG is down -70% over the last 6 months. February-to-date it is positive.

Staying with energy, we saw in the assessment of the SPX sectors that XLE seems to be reversing its trend to bullish. We also see the bullish trending of XOP and OIH continue. The USO trending also seems to be reversing and is back up this year. So, energy (the legacy one) could be heading higher in the near-term.

The ARK funds went from poor trending to better trending and possibly back to poor trending all within the last 6 weeks. Just as their January performance was the highest, their February losses are also among the highest.

The US Dollar index seems to be reversing from its bearish trend to a bullish trending pattern. It has a positive return for February-to-date and if it continues to strengthen it could spell risk for the equity markets.

Actions:

I am long UNG and UUP call options. I am short SPY, QQQ, XLV, XLP and XLY using put options. I will balance this position out with some long position in Energy. This is my short-term stance defined as 2 days to 2 weeks. But I will continue monitor and evaluate for changes in trending and take corrective actions as needed.