Week 50 Sectors Trending and Performance

Trending Heat Map

Not surprising to see a lot more amber in the trending heat map than from last week. Silver SLV and Gold GLD continue to trend well. Interestingly US Home Construction ITB looks good even though Homebuilders XHB does not look that well. I added ITB to my list as it is different from XHB which also has the retail stores such as Home Depot as its constituents.

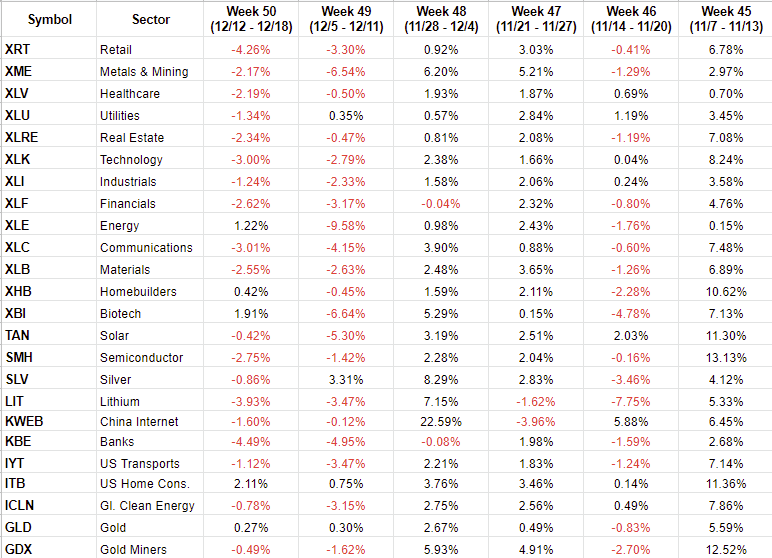

Week-over-Week Performance

Mostly red for the last week although Biotech XBI and US Home Construction ITB had good weeks. The ITB has been up now 6 weeks in a row which is impressive considering the relative weakness of other markets. I am long China Internet KWEB, Silver SLV, Gold Miners GDXU, Biotech XBI and US Home Construction ITB as of now. I am short Industrials XLI and Energy XLE aside from S&P 500 SPY and NASDAQ 100 QQQ.

Performance 2022

Key Observations:

Only Metals & Mining XME, Energy XLE and Silver SLV are profitable for the year-to-date. SLV is just about break-even. But what did well in 2022 may not be the ones that do well going forward.

Only Silver SLV, China Internet KWEB and ITB US Home Construction are profitable in the month of December. All of these sectors are also trending relatively better than the rest of the markets.

For the year, Retail XRT, Real Estate XLRE, Technology XLK, Communications XLC, Homebuilders XHB, Biotech XBI, Semiconductor SMH, Lithium LIT, Banks KBE, Transports IYT and US Home Construction ITB have all underperformed the S&P 500.

In December so far, Retail XRT, Metals & Mining XME, Technology XLK, Financials XLF, Energy XLE, Communications XLC, Semiconductor SMH, Lithium LIT, Banks KBE and Transports IYT have all underperformed the S&P 500.