Week 47 Global Markets Trending and Performance

Trending Heat Map

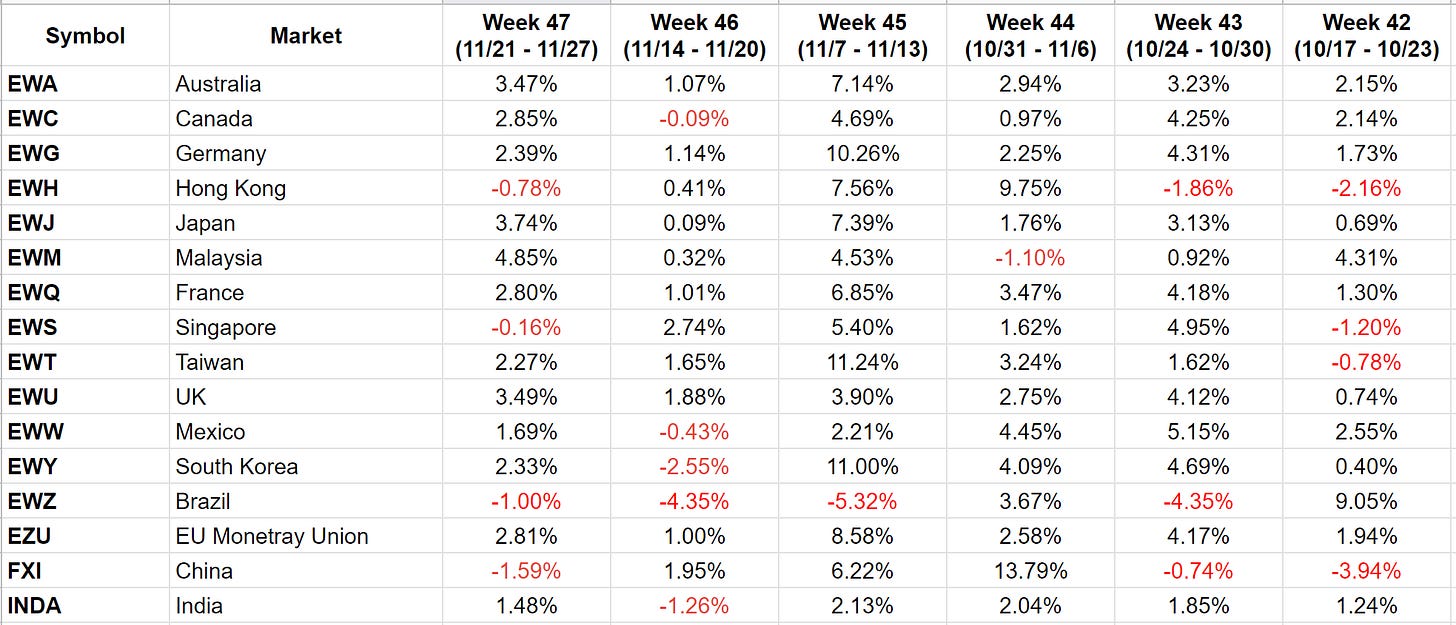

Week-over-Week Performance

Performance 2022

Technical Observations

The Eurozone EZU looks to be in a nice bearish to bullish reversal. It is one of the few that has done well over the last 3 months. It has delivered positive returns the last 6 weeks in a row. I will watch for a bullish play in future.

Australia EWA is interesting in that there is an unfilled gap of about 5% to the upside which it looks like will be filled soon. It has also had positive returns over the last 6 weeks in a row.

Japan EWJ looks to be making a bearish to bullish reversal. It has delivered 6 straight weeks of positive returns. Watch closely to make a potential bullish play.

Hong Kong EWH has some big unfilled gaps all the way down to17. It is currently trading at 19. I had a poor week and looks like one of the weakest of the global markets. I will watch to potentially make a bearish play.

India INDA seems to have a strong resistance around the 44 level. If it can cross that level in a meaningful way, it could be a good bullish play.

China FXI was weak this week similar to the Hing Kong market. It could be ripe for a short-term bearish play. I will watch and take action if it continues with its weakness.