Week 47 Global Markets Trending and Performance

Trending Heat Map

Some small cracks seem to be opening up. In general prices seem to be retreating a bit and we see that for some of them the price has dipped below their 10-day moving average. More importantly, the green in the heat map does not seem to be advancing left to right anymore. The bullish momentum seems to be stalling.

Canada, Malaysia, Mexico, South Korea and India price have all dipped below their 10-day moving average. Brazil continues to fall precipitously, and the trending remains perfectly bearish.

Week-over-Week Performance

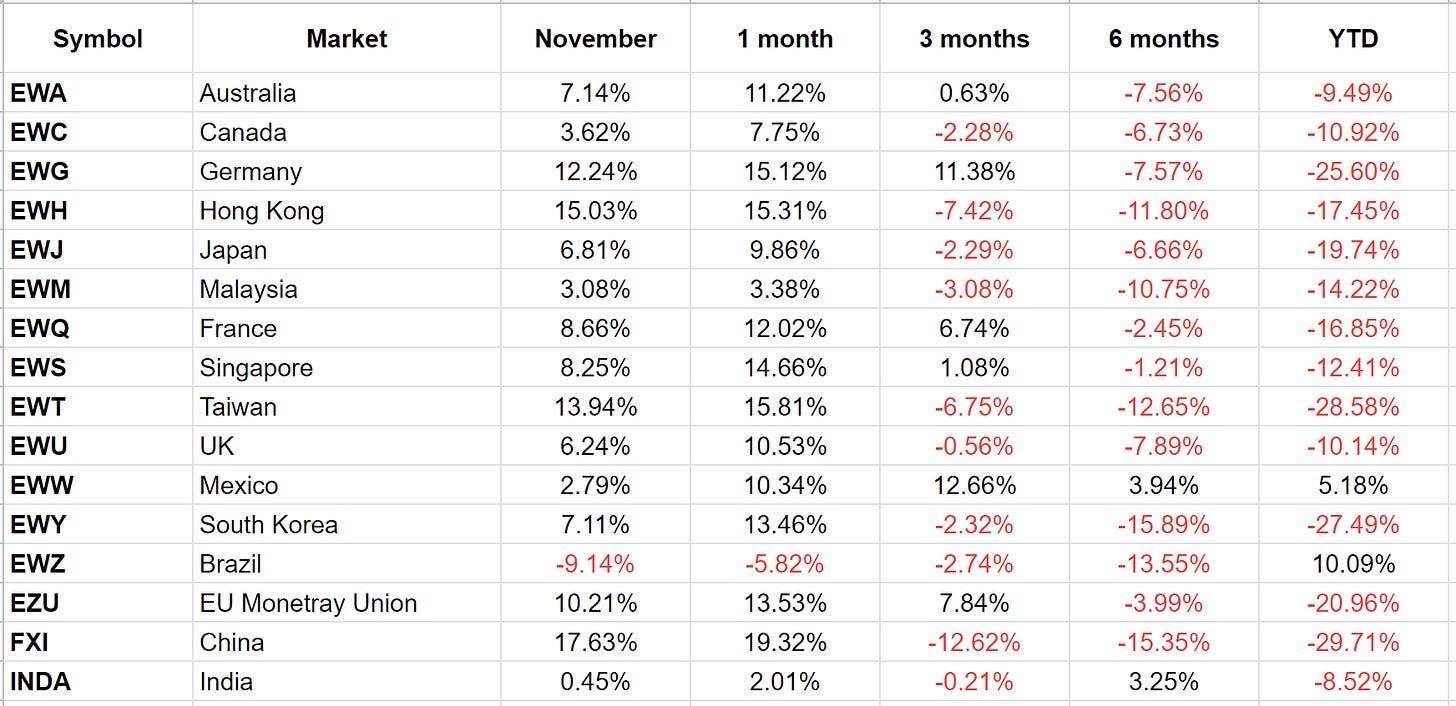

Performance 2022

Observations:

Mexico has been the best performer to date this year. They have delivered positive returns through the year and all periods of observation.

Brazil is still positive for the year but has been performing very poorly recently.

There are several countries/regions that have outperformed the S&P 500. Australia, Canada, UK, Mexico, Brazil and India have all lost less than the S&P 500 so far. The point being it makes a lot of sense to track global markets to identify better performing markets.

The Eurozone EZU is showing signs of a bearish to bullish reversal. The price is above its 150-day moving average but seems stalled at a resistance level of 39-40. With a breakout above this level, a bull run could be on.

Conclusion:

Europe is in the middle of political and economic crises almost across the board. However, the stock markets seem to be perking up. Most of the Country/Region indexes from Europe that I track are looking like making a bearish to bullish reversal. The price is stalling at their resistance levels. So, it remains to be seen whether they can breakout. I will be watching closely.