Week 46 Sectors Trending and Performance

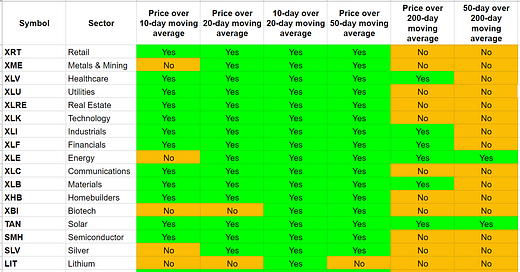

Trending Heat Map

The Metals & Mining sector XME price pulled back and crossed below the 10-day and the 200-day moving averages.

The Energy sector XLE price crossed below the 10-day moving average.

The Communications sector XLC price turned short-term bullish finally. The 10-day crossed over the 20-day moving average.

The Biotech sector XBI price crossed below the 10-day and the 20-day moving averages.

The Silver metal SLV price fell below its 10-day moving average.

The Lithium sector LIT price fellow its 20-day and 50-day moving averages. It was a sharp turnaround and looks like will turn bearish soon.

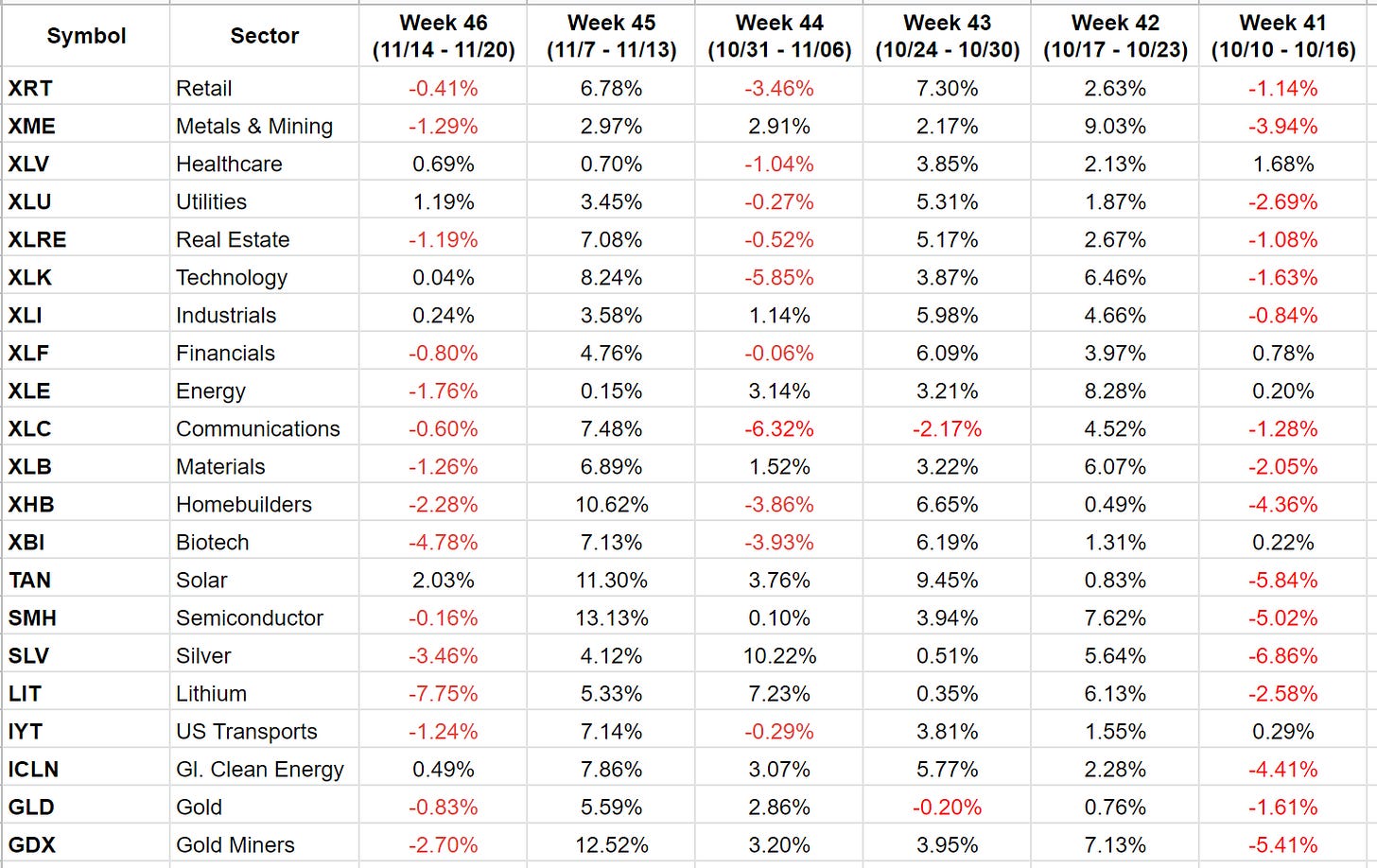

Week-over-Week Performance

Performance 2022

Other Technical Observations

XRT Retail - Consolidation at the 150-day; may bottom out here; WATCH for upside play

XME Metals & Mining - Very choppy; AVOID

XLV Healthcare - Seems like 134-135 is a ceiling - hit it 3 times and fell - expect a similar result this time; AVOID

XLU Utilities - Hit resistance at around 68.5 - will it break out; it could go either way; AVOID

XLRE Real Estate - Big resistance on 38.9; looks like falling back down; AVOID

XLK Technology - Consolidation on the 150-day; looks like will break down from here; WATCH for short play

XLI Industrials - Moved up quite a bit and now hitting resistance at 100. Could easily fall -10% from here. WATCH for short play

XLF Financials - Hit resistance at 32 and fell back; seems like will fall back to 150-day. AVOID

XLE Energy - Stalled around June high of around 92; support is 82.56 and resistance 92.28. AVOID

XLC Communications - Price at 49.5 between support at 49.6 and resistance at 52.3; could be a short play. WATCH for short play

XLB Materials - Hit a resistance at 82 and fell back down; AVOID

XHB Homebuilders - Stuck between 54 - 64; could have a upside breakout. WATCH

XBI Biotech - Looks like a head and shoulders bottom; could break out to the upside soon. WATCH for long play

TAN Solar - Price at 81.5 between support 78.7 and resistance 89.8; can play for some upside here; BUY

SMH Semiconductor - Could be breaking out of 150-day and lower high trendline. WATCH for long play

SLV Silver - Price fell down from resistance of 20.22 down to the next support of 19.27; price above 150-day and looks to be doing a bearish to bullish reversal; BUY

LIT Lithium - Seems range bound between 65 - 80. Needs to settle down, create a bottom and then indicate bullish reversal. AVOID

IYT US Transports - Hit lower high trendline and fell back. AVOID

ICLN Gl. Clean Energy - Very choppy. AVOID

GLD Gold - Recent high 161.23 and then pulled back; support is at 161.65 and resistance at 167.75; seems to be bearish to bullish reversal; BUY

GDX Gold Miners - Took a breather at 28.5 as expected; seems to be a bearish to bullish reversal; BUY