Week 46 Major Markets Trending and Performance

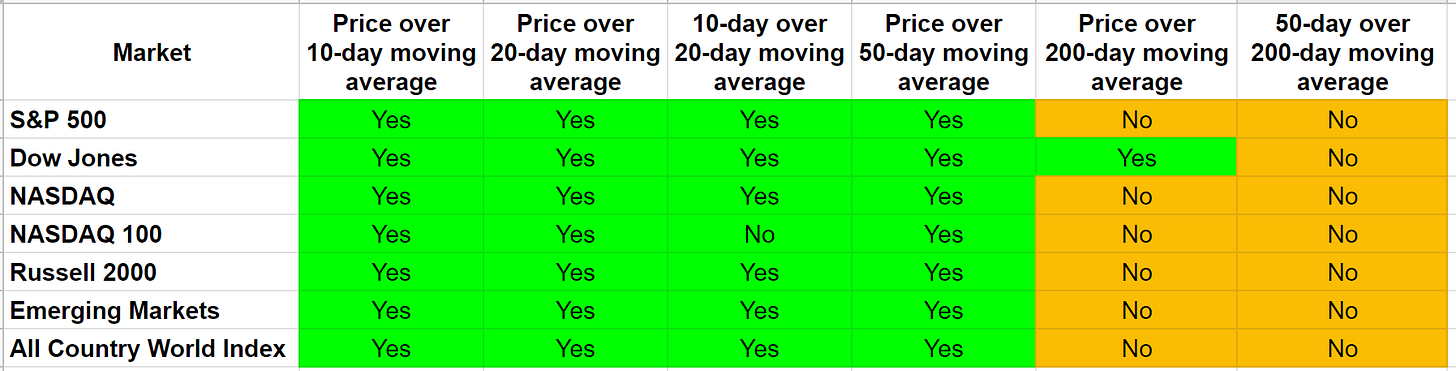

Trending Heat Map

S&P 500: No change from last week. It is trending short-term bullish, and the price is also over the 50-day moving average.

Dow Jones: No change from last week. It is trending short-term bullish, and the price is also over the 50-day and 200-day moving averages.

NASDAQ: It turned short-term bullish with the 10-day crossing over the 20-day moving average.

NASDAQ 100: No change from last week. It is trending short-term bullish, and the price is also over the 50-day moving average.

Russell 2000: No change from last week. It is trending short-term bullish, and the price is also over the 50-day moving average.

All-Country World Index: No change from last week. It is trending short-term bullish, and the price is also over the 50-day moving average.

Week-over-Week Performance

Performance 2022

Observations:

The Emerging Markets EEM is having a strong month. It has positive performance the last 5 weeks which is the only market to do so. Also, its return in November indicates it could be a leader if there is a bullish reversal in the short-term.

The Dow Jones is the only market whose composite price is above the 200-day moving average. It has had the best performance over the trailing 1 month. It is also the only one with single digit losses this year.

The S&P 500 retained its short-term bullish trending but was not able to deliver a positive return this week. That tells us there is not a lot of strength in the trending as of now. It has had a good trailing 1 month though.

The NASDAQ and NASDAQ 100 managed to turn short-term bullish. However, the trend change was mostly driven from the prior week strength. This week it was weak which indicates the strength may be weakening.

The Russell 2000 was the weakest this week among all the markets. It still has a positive November to date, but strength seems to be weakening.

The All-Country World Index is behaving somewhat similar to the S&P 500. It is trending short-term bullish, but strength could be weakening.

Conclusion:

Although all markets are now trending short-term bullish, the strength could be weakening based on what we saw in last week’s price action. So, I am going to be cautious and remain open to the possibility that we reverse course and start losing some ground again.