Week 45 Major Markets Trending and Performance

Here is the trending heat map at the end of week 45.

Interesting situation with the trending. I would call the markets mostly trending bullish now at least for the short-term. The key observation is that NASDAQ and NASDAQ 100 are underperforming compared to the others. The Dow Jones and the Russell 2000 are the leaders as we have seen in the past few weeks.

I believe this trending bodes well for the markets in the short-term. I will take off my shorts and go long for a short-term play. Whether this short-term bullish trending converts into a long-term upswing in the markets remains to be seen.

There are also not many catalysts for the markets to go either direction with high volatility this week. So, we can assume that the VIX will stay flat or go down a bit. It is still high and hovering at around 22-23 at this time.

Here is the week-over-week performance.

Last week was a big one for all the markets buoyed by the Fed expectations of pivot given the better-than-expected inflation numbers. I go by trending and as we can see above the trending is strong to the bullish side. And even though I do not think it is going to be all up and above going forward I will play the markets for the upside for now.

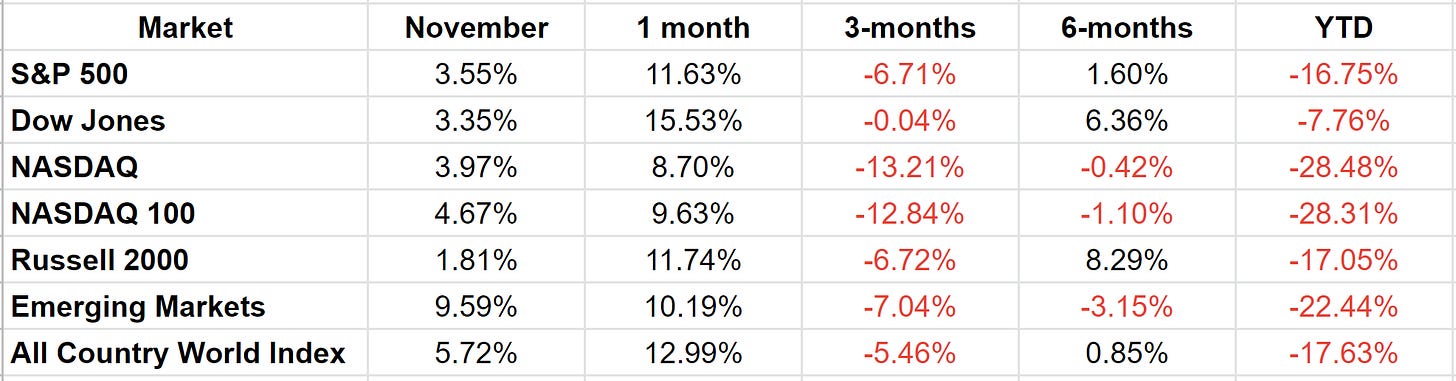

Here is the performance over several periods.

We can see the strength of the markets over the last month. In some respects, one could say it is too much too soon. But we are not here to judge. Interestingly, some of the markets are now showing positive returns over 6 months. Especially, the strength of the Russell 2000 is interesting and tells us that smaller stocks who likely have lesser impacts of high rates have done better than the other markets.

All markets are still negative for the year, and it will be interesting to see if they continue to make up ground the last few weeks of the year.