Week 45 Global Markets Trending and Performance

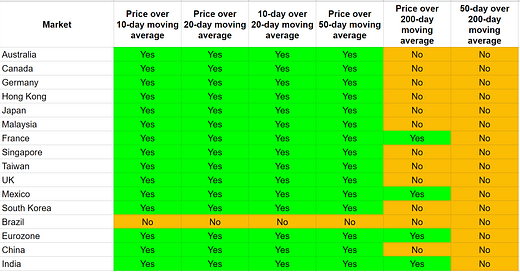

Here is the trending heat map for the Global Markets.

The first thing that jumps out at me is the trending for Brazil EWZ which turned perfectly bearish within a week. The prior week it was trending short-term bullish and looking like improving upon that. The chart needs to be seen to understand what is going on.

We can immediately see the volatility in the stock price. Brazil did go through an election recently and the results were surprising to some. That is the only reason I can think of.

Other than that Mexico EWW and India INDA maintains their bullish trending and continues to remain strong. Most other markets showed good trending including China and Hong Kong which had been weak before.

Here is the week-over-week performance for the Global Markets.

Staying in line with what we saw in the trending heat map, Brazil EWZ was the only one with negative returns last week. The big winners from last week were Germany EWG, Taiwan EWT and South Korea EWY. Aside from these, both Hong Kong EWH and China FXI have notched up strong gains 2 weeks in a row.

Let’s look at the performance over several different periods.

Brazil EWZ has been underperforming and the return has been poor for the last month. Although, it is one of only 2 that are positive for the year. The other one is Mexico EWW. However, Brazil as we saw above has been very volatile and I do not have the stomach to play it in either direction for now.

The interesting ones to me are China FXI and Taiwan EWT. They have been moving mostly in sync so I will review FXI in greater detail. The first thing to see is that FXI is down -30% year-to-date which is the poorest performance of all.