Week 34 Stock Markets Trending Report

The stock markets turned somewhat bearish this week. Almost everything I track turned weak. The ones that stood out against the grain are in bold below.

The Energy XLE and Metals &Mining XME are moving in opposite direction of the S&P 500. Could perhaps be a counter play.

Brazil and China showed some strength among the countries.

Meanwhile US Oil and US Dollar are both going strong.

Major Markets

The S&P 500 price dipped below its 20-day moving average.

The Dow Jones price dipped below its 10-day and 20-day moving averages.

The NASDAQ price dipped below its 20-day moving average. The 10-day moving average is also very close to crossing below the 20-day moving average which will signal a reversal to short-term bearish trend.

The NASDAQ 100 has reversed and turned short-term bearish. Its 10-day moving average has just about crossed its 20-day moving average. The price also fell below its 20-day moving average.

The Russell 2000 price has fallen below its 20-day moving average.

The Emerging Markets price weakened but it did close above its 50-day moving average.

Major Sectors

Energy XLE price crossed above its 10-day and 20-day moving average. It has now turned perfectly bullish.

Metals & Mining XME price crossed above its 10-day moving average.

Financials XLF price crossed below its 20-day moving average.

Industrials XLI price dipped below its 10-day, 20-day and its 200-day moving average.

Materials XLB price dipped below its 20-day moving average.

Transports XTN price turned short-term bearish with its 10-day moving average crossing below its 20-day moving average. The first sector to turn short-term bearish in this round.

Utilities XLU price dipped below its 10-day and 20-day moving averages. Note that XLU was perfectly bullish last week.

Healthcare XLV is the first sector this round to turn perfectly bearish. In 1 week, the price has dipped below the 10-day, 20-day and 50-day moving averages. Also, the 10-day crossed below the 20-day moving average.

Consumer XLY price dipped below its 20-day moving average.

Real Estate XLRE price dipped below its 20-day moving average.

Retail XRT price dipped below its 20-day moving average.

Technology XLK price dipped below its 20-day moving average.

Homebuilders XHB price dipped below its 20-day moving average.

Semiconductors XSD price turned short-term bearish. The price dipped below its 20-day moving average and the 10-day crossed below the 20-day moving average.

Biotech XBI is very close to turning short-term bearish. This week it barely held on.

Gold Miners GDX has turned perfectly bearish. This week the short-term indicators turned bearish.

Countries

Australia EWA turned short-term bearish.

Canada EWC price dipped below its 20-day moving average.

Germany EWG turned perfectly bearish.

Hong Kong EWH remains perfectly bearish.

Israel EIS price dipped below its 10-day moving average.

Japan EWJ turned short-term bearish.

Singapore EWS turned perfectly bearish.

United Kingdom EWU turned perfectly bearish.

Brazil EWZ price crossed over its 10-day moving average. The price also crossed over its 200-day moving average.

China FXI price crossed above its 10-day and 20-day moving average.

India INDA price dipped below its 20-day moving average.

Indonesia EIDO price dipped below its 20-day moving average.

Malaysia EWM turned short-term bearish.

South Korea EWY turned perfectly bearish.

Taiwan EWT price dipped below its 20-day and 50-day moving average.

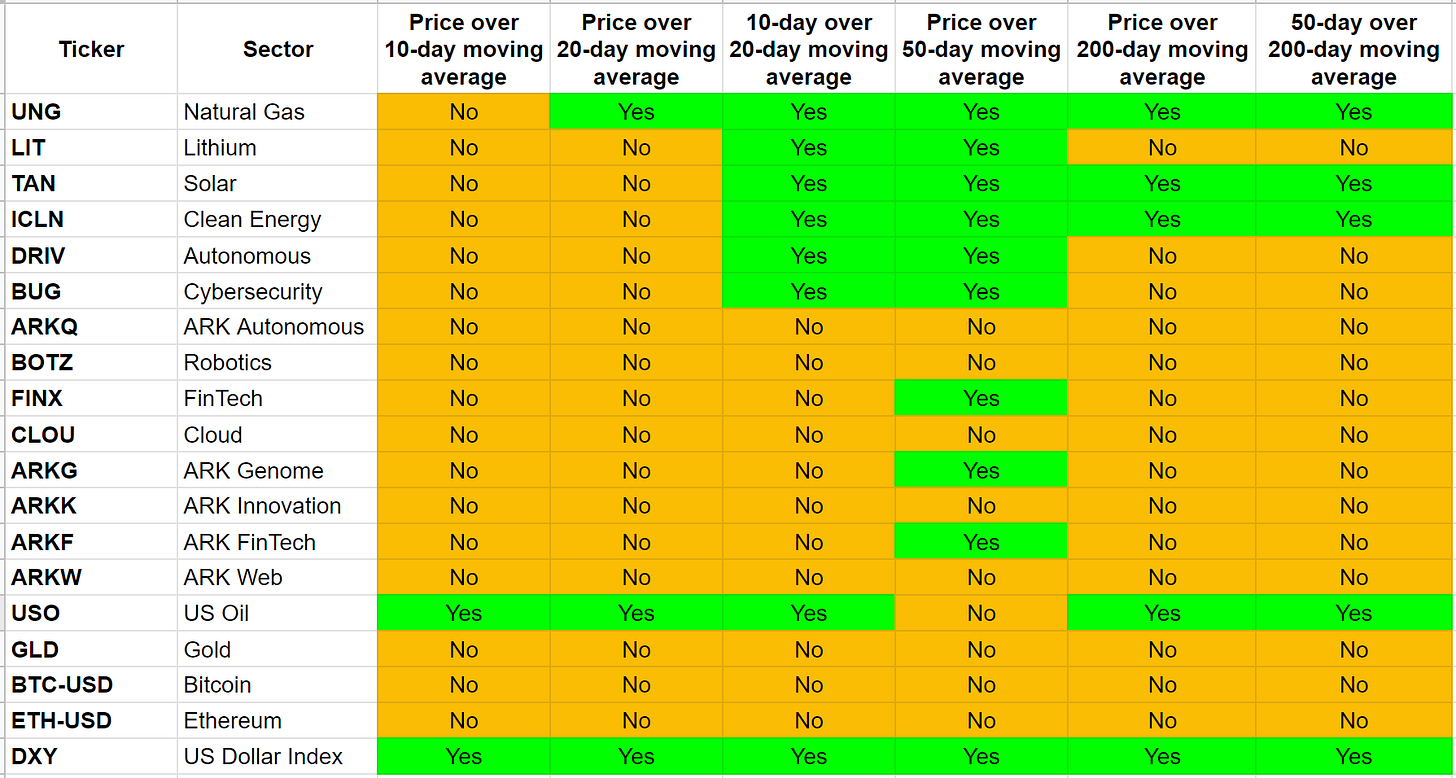

Alternate and Thematic Sectors

US Natural Gas price dipped below its 10-day moving average.

Lithium LIT no change in trending.

Solar TAN price dipped below its 20-day moving average.

Clean Energy ICLN turned long-term bullish although its price dipped below its 20-day moving average.

Autonomous Driving DRIV price fell below its 20-day moving average.

Cybersecurity BUG price dipped below its 20-day moving average.

ARK Autonomous ARKQ has turned perfectly bearish.

Robotics and AI BOTZ has turned perfectly bearish.

FinTech FINX turned short-term bearish.

Cloud CLOU turned perfectly bearish.

ARK Genomics ARKG turned short-term bearish.

ARK Innovation ARKK turned perfectly bearish.

ARK Fintech ARKF turned short-term bearish.

ARK Web ARKW turned perfectly bearish.

US Oil USO turned short-term bullish.

Gold GLD has turned perfectly bearish.

Bitcoin BTC has turned perfectly bearish.

Ethereum ETH has turned perfectly bearish.

US Dollar DXY is trending perfectly bullish.