Week 32 Stock Markets ROI

The stock markets did quite good again this week. That is 4 weeks in a row.

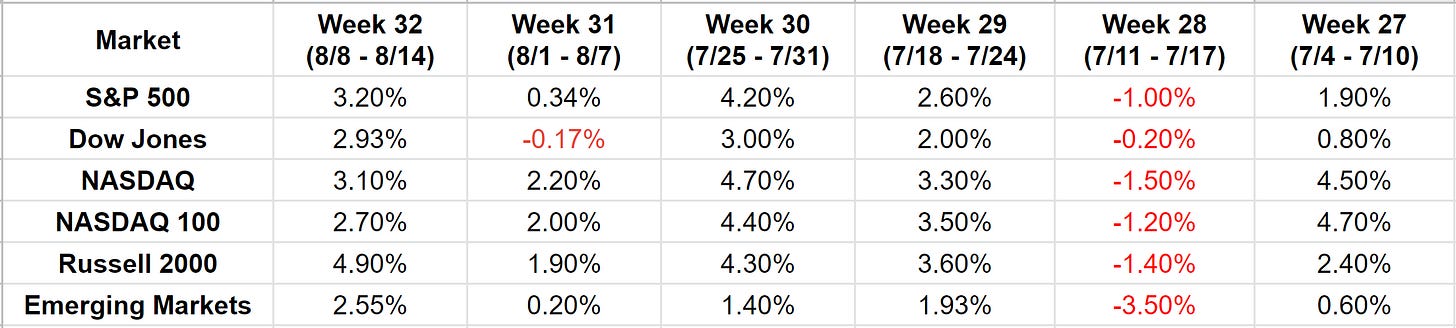

Major Markets

Big gains in the major markets again this week with the Russell 2000 taking charge. Being up 4 weeks in a row does beg the question is week 5 going to be down? The 1-month trailing returns are:

S&P 500 +12.1%

Dow Jones +9%

NASDAQ +15.8%

NASDAQ 100 +15.4%

Russell 2000 +16.7%

Emerging Markets +5.6%

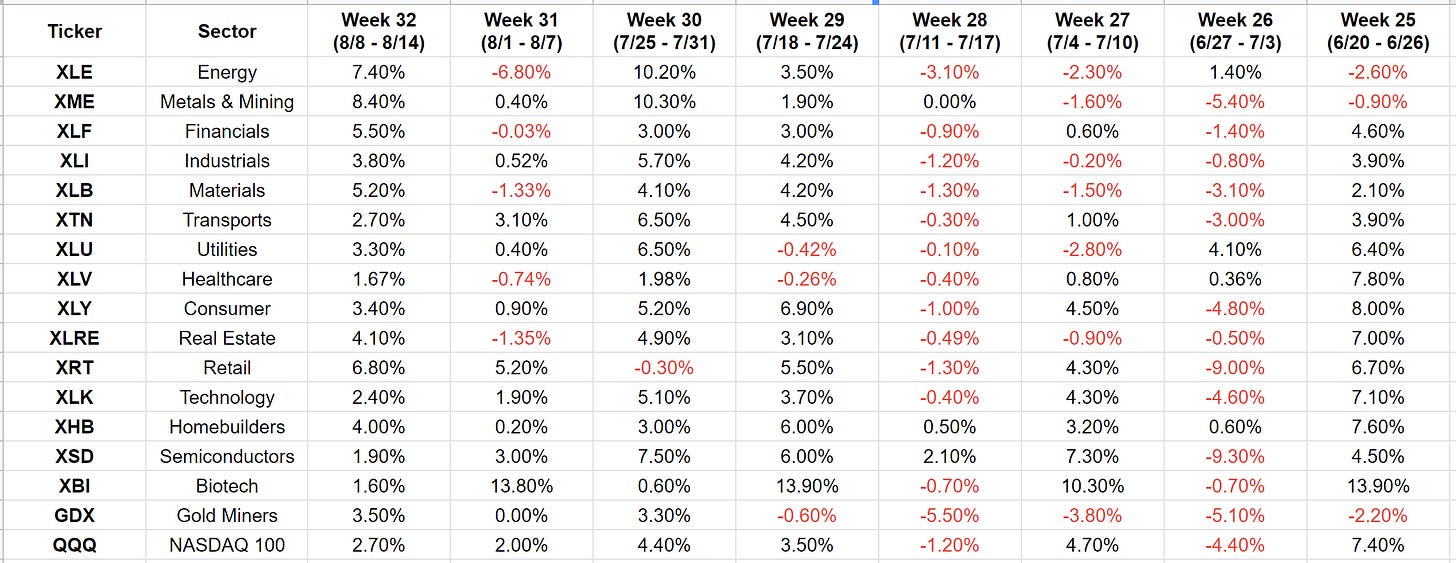

Major Sectors

Every sector was positive this week. Here is the 1-month return:

Mostly double-digit returns for the trailing month. Semiconductors, Retail, Metals & Mining, Transports and Consumer discretionary are the leaders.

Alternate and Thematic Sectors

We see the same situation with the alternate and thematic sectors. All have positive returns for the week.

Countries

Again, everything positive.

Conclusion

All the markets were positive last week. Even China, which is trending bearish, ended slightly positive. What does that mean for next week? I think you know what I am thinking. The probability of a negative week is higher now with more markets having been positive for 4 straight weeks. That does not mean next week will be negative. I do not predict. Just that the chances are higher than 50% it will be negative. Play accordingly.