Week 32 SPX Sectors Review

The XLE has become a nice long trade in this pullback so far and looks to continue its upward move in the near future. We saw this phenomenon in the early part of 2022 as well when XLE was doing well, and the rest of the market was not.

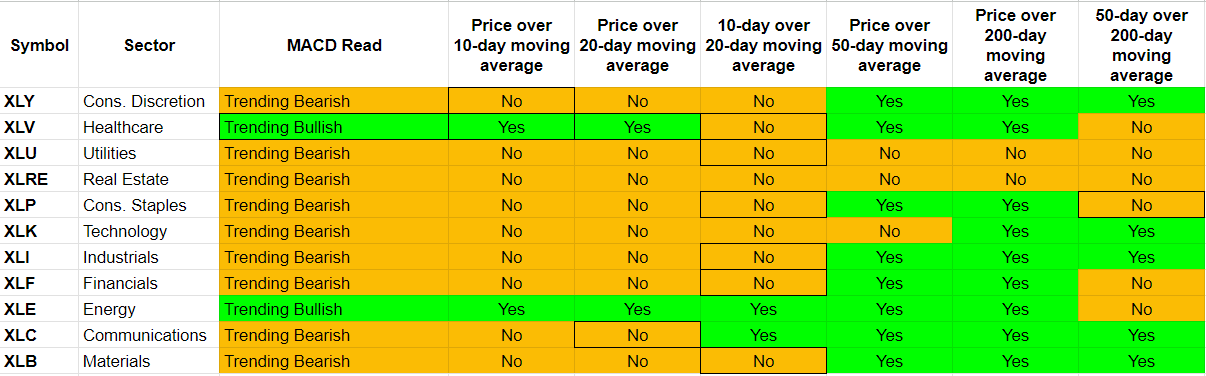

Trending Heat Map

Most sectors turned short-term bearish. XLE is trending bullish and XLC is weak but technically still not trending bearish. XLV is showing signs of life.

Performance

XLE and XLV have become the defensives in this pullback. Both of them registered gains this week. All others, especially XLK, fell hard over the week.

Week-by-Week Performance

Interesting that the SPY was down -0.26% for the week and yet 8 out of the 11 SPX sectors were actually up. So, is this just money transfer from the high-fliers to the underperformers? If so, then this is classic rotation and not a real pullback.

Weekly Expected Moves

This week 3 sectors overshot their expected range: XLE and XLV to the upside and XLK to the downside. But all overshoots were within a 0.8% range. For week 33 here are the expected moves:

(Note that XLRE does not have weekly options.)

Strategy

I have mostly been trading the XLE to the long side over the last 2 weeks. That and the short trade on QQQ and IWM have been profitable. I expect the same strategy to be profitable the next week as well. I could look to replace the QQQ with the XLK as that is more of a technology pure play. The risk for the broader markets remains to the downside. The XLE may decide to take a breather soon as it has risen quite sharply recently. Also dependent on the price of oil of course.