Week 32 Magnificent 8 Review

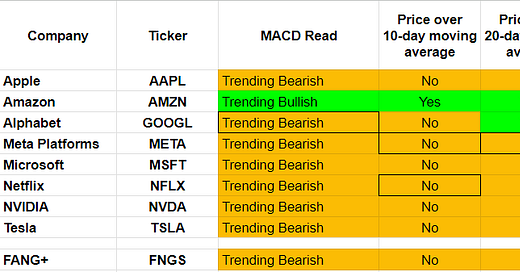

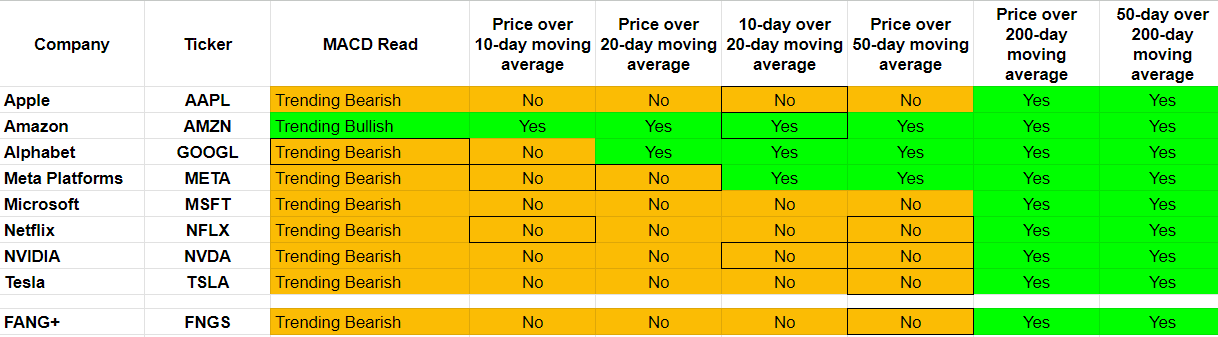

Trending Heat Map

Most of the stocks trending worsened except for AMZN which actually got better. As of now AMZN is trending perfectly bullish. GOOGL and META is holding on to their bullish trending although both weakened. And, aside from these 3, all of the other 5 are trending short-term bearish.

Performance

It is still only about half-way through the month of August. So, there is time for the stocks to recover at least some of their August losses. The NVDA, TSLA and AAPL losses are glaring though.

Week-by-Week Performance

NVDA is the big loser of the week. Note that it declares earnings results on August 23. It is the last of this lot. And that’s a big fall over the last 2 weeks.

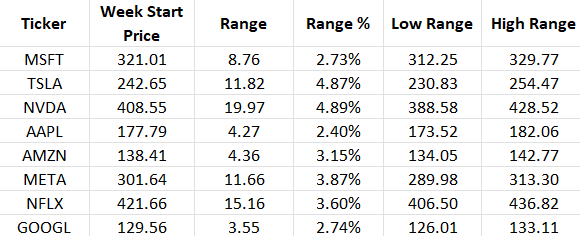

Weekly Expected Moves

This week NVDA closed way beyond its weekly expected move to the downside. The price overshot by -4.4% to the downside.

TSLA and NVDA have the best ranges for trading. But of course, one has to be sure about the direction. The trending looks bad for both.

Strategy

A safe play for next week would be to short TSLA and/or NVDA on any upswing. Their trending has been poor, and I do not see any catalyst to take them higher at least next week. A safer play would be to use QQQ. Note that TSLA is not part of XLK. It is part of XLY.