Week 31 SPX Sectors Review

We saw that the major markets weakened this week. Let us see how the individual sectors are doing.

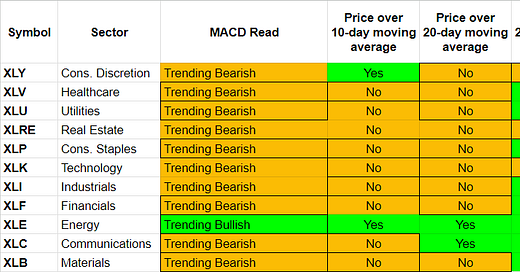

Trending Heat Map

The picture indicates a lot more weakness and asks for lot more caution.

The one below is from Week 30:

We can see the changes in just 1 week.

The XLY, XLK and XLRE are trending short-term bearish. (XLRE is trending perfectly bearish).

Performance

The XLE had a gain of +7.77% for July. However, for the year-to-date it is really flat. As we saw for the major markets, here too the first 4 days of August has been quite bad universally.

Week-by-Week Performance

The XLE is now up 4 weeks in a row. The XLRE is down 3 weeks in a row. There are always winners and losers in the mix.

Week 32 Expected Moves

All of the above have weekly options. Interesting to see that the XLE, XLU and XLB have the widest ranges as seen from a percentage basis. The XLU had a move of -4.55% for last week. That could be the reason for its big, expected move next week as well.

Strategy

The XLE clearly is having a good bull run and also going against the rest of the markets. We saw this in 2022 as well when it performed well most of the year when the rest of the markets were going down. It is up 4 weeks in a row though. So, I would be cautious to put new money.

My trading will be focused on the QQQ and IWM for the most part next week. Among the sectors, I will watch the price action against the expected moves and take actions when I see big divergence with that.