Week 30 SPX Sectors Review

Let’s check-in on who is zooming and who is not.

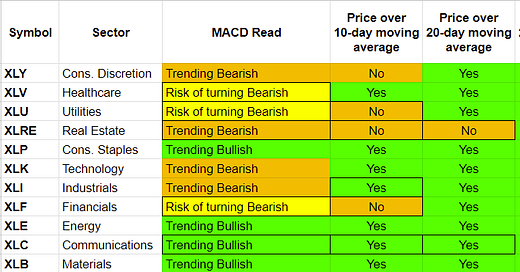

Trending Heat Map

The challenge when markets are trending bullish for so long is that the strength can weaken, and they start to go through their cycle. We may be starting to see some signs of that. Although the XLC reversed its weakening and turned back to perfectly bullish this week. That was driven by GOOGL and META performing well post earnings.

Week-by-Week Performance

Not much to glean from the weekly performance. Week 28 was 100% green and the next 2 weeks we have seen some weakness in some sectors. XLRE seems to be the weakest from the last 2 weeks performance as well as the trending. XLP, XLK, XLI, XLE and XLB all have positive performances over the last 3 weeks.

Month-by-Month Performance

June and July (so far) are the only months in the year where all the sectors are positive. We have 1 trading to go in July and only XLRE may stop the sectors from having a perfect month.

Looking at the numbers in a different way:

We see the heavy outperformance of the technology laden sectors of XLK, XLC and XLY.

XLK has AAPL, MSFT and NVDA

XLC has GOOGL, META and NFLX

XLY has TSLA and AMZN

(I will cover these 8 stocks in a note tomorrow).

Strategy

All the sectors are trending bullish. XLRE is looking the weakest of the lot and XLY seems to be losing steam. However, AMZN releases earnings next week and it is a major component of the XLY. So, we need to watch for that.

To me it is a wait and watch strategy for now. We see some weakening but not enough to play with big money to the downside. We can make small size quick trades either way based on day-to-day swings. But nothing beyond that.