Week 29 Markets Review

“What has happened are facts. What is going to happen in the future are opinions.”

With that out of the way, let us look at the facts.

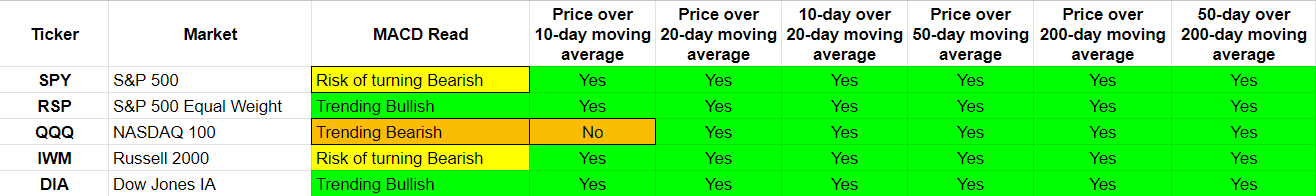

Major Markets Trending

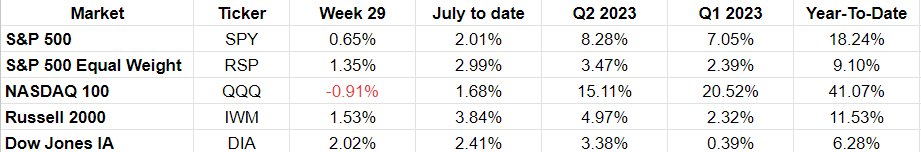

We can see some degradation in the trending with the worst hit being the QQQ. Before we start thinking this is the beginning of the fall, lets note that the returns were still mostly positive for the week.

Only QQQ had a negative week, and it is where we see the trending change somewhat. Also, that is the only negative number in the table above.

Note that my characterization of “risk of turning bearish” is when I see the MACD histogram start to reduce (I call it “trending bearish” when it turns negative). There remains a chance that the histogram reverses and starts increasing again before turning negative. So, the MACD read can change from “risk of turning bearish” back to “trending bullish”. It is just an early warning that it may turn bearish.

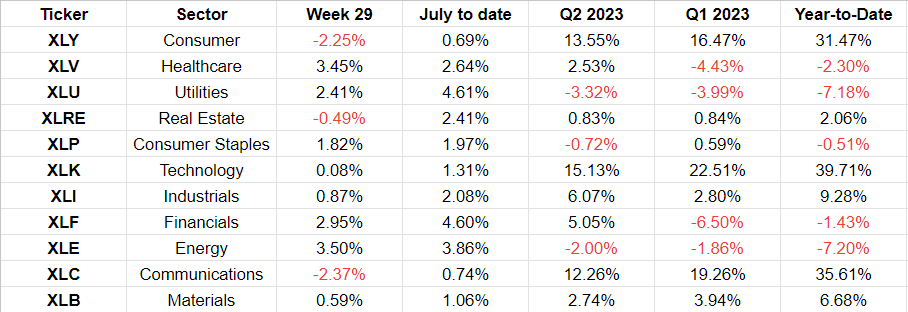

SPX Sectors Trending

We see more of a negative trending in here particularly with the big 3: XLY, XLK, XLC. These 3 have been the leading sectors so far this year. The XLV and XLE trending improved.

Here are the returns for the week and other periods.

The longer periods provide a good perspective. The nearer period numbers provide me with more actionable information for the here and now.

We can see that the trending is somewhat confirmed by the 1 week and the month-to-date returns. There has been a slight move towards the defensives like XLV, XLU and XLP. There has also been a move to rotate over from XLY, XLK and XLC over to XLF and XLE.

Tradable Opportunities

QQQ: Among the major markets, the risk/reward seems to look good for a short trade on the QQQ. Earnings season is upon us, and we know that several of the highfliers are fairly elevated. So, any small negativity may cause a reasonably big move downwards as we saw with TSLA and NFLX so far.

SPX Sectors:

Between XLY, XLK and XLC, one can pick which one (or two) to play short. I would say, if one is playing QQQ to the short side, XLY may be the one the more differentiated pick to play to the short side.

From a rotation perspective, XLF and XLE can be played to the long side. If I had to pick 1, I would pick XLE because earnings this quarter are still outstanding and also the correlation with SPY is 0.66 whereas the XLF correlation is 0.86.

From a defensive perspective, XLV and XLU look good for trades to the long side. Although, they have been up 3-4 days in a row and may have a small pullback soon.

Alternate Sectors:

SMH: A trade to the short side looks good from a risk/reward perspective. The MACD histogram turned negative.

ITB: MACD histogram turned negative. Could be a short play.

EWW: MACD histogram turned negative. Could be a short play.