Week 25 Day 3 Market Trends

The market went back again to the tech sector today for safety. The QQQ was up +1.19% and the IWM was down -0.75%. The SPY landed in the middle up +0.37% and the DIA ended flat.

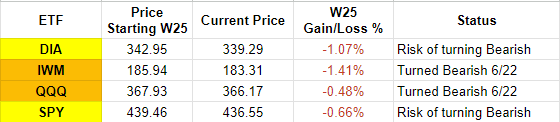

Per my short-term trend analysis, both the IWM and QQQ are now trending bearish. The DIA and SPY are at risk of doing so.

Note again that this trend analysis is for very short-term trades anywhere between few days to few weeks. It should not be considered as the general trend of the market. Moreover, this trend is derived only using the MACD as the indicator.

I also mentioned in yesterday’s note that trending bearish does not mean price goes down in a straight line. So, when trading based on this indicator, one has to be sensitive to short-term mean reversions as well.

Overall, my outlook is negative for the markets in the short-term. Here is the full list of ETFs that I track.

We can see that the defensives like XLP and XLV are looking better while others are looking bad. The XLY is trending bullish primarily because the ETF has TSLA and AMZN as the major contributors. The housing sector has been surprisingly strong. Also, Bitcoin has had a boost from the traditional financial institutions planned adoption.