Week 23 Major Markets Trending and Performance

The S&P 500 is declared to be in a bull market per the definition of a +20% rise from the bottom reached in October 2022. However, (and there is always a however, is it not?) we also know that the bulk if not all the gains are due to a few tech stocks that make up a majority of the index. When, in a business the majority of its revenues is derived from a very few customers, it is considered a risk. This S&P 500 situation is also a risk.

All the 4 major US indices have tried to break through their overhead resistance bands and failed (some several times). All of these also have recent unfilled gaps below. So, what we are really looking to see is whether the resistance is breached, or the unfilled gaps below get filled first.

We saw an attempt by the broader market to take leadership as witnessed by the outperformance of the Russell 2000 (IWM) against the NASDAQ 100. It did happen but fizzled out somewhat in the last 2 trading days. Having said that, the IWM may just be taking a breather and may take back the leadership next week. That is entirely possible and, in my opinion, the likely scenario.

But remember, we should not trade based on our opinions. We should trade based on what we see and not what we think.

Trending Heat Map

The trending improved for the Dow Jones, Emerging Markets and China. Now we have the S&P 500, NASDAQ 100, Dow Jones and Emerging Markets all trending perfectly bullish. Note that the S&P 500 and NASDAQ 100 have been perfectly bullish for a while and so mean reversion may be approaching. I am not predicting that but will need to look out for that. We will go deeper when we do chart observations later in the note.

Performance

(Note that I calculate performance from the open price of the start date of the period of calculation. Another way of calculating would be start from the close price of the prior day of the period. There will be minor differences in the final numbers based on which way the returns are calculated.)

It is still early in June, but we can see that the NASDAQ 100 has been sluggish. The downside risk is that the NASDAQ 100 had been the big leader going up through the year so far and it could also be the leader taking us down. I am again not predicting but just making observations and what we need to watch out for.

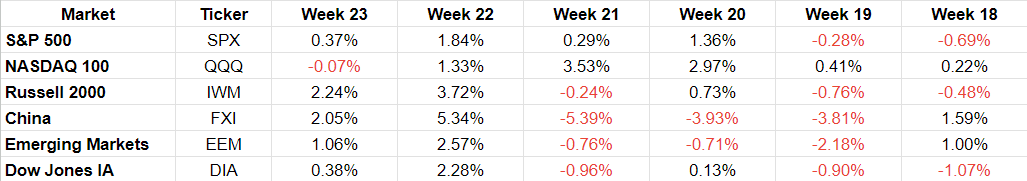

Weekly Performance

The last 2 weeks we are seeing some broadening of the markets with the Russell 2000 outperforming the NASDAQ 100 and the S&P 500. As we all know, the NASDAQ 100 and the S&P 500 have been buoyed by a very few tech stocks so far this year. The NASDAQ 100 had a slightly down week after 6 straight up weeks.

Chart Observations

SPY: The price is a bit too far away from the 150-day moving average for my comfort. The price also failed to clear the resistance at 430 although it is very close and may do so. It has tried to do that for 6 trading days now and failed. The 7th day may be the day. Or maybe it is not meant to happen just yet. There are 2 unfilled gaps below. The first one is at 422.92 which is -1.62% below current level. It seems likely now that this gap will get filled first before the resistance at 430 is breached. I stick with my plan of going long over 430 and going short below 426 (both at close). Until then no trade.

QQQ: The MACD line is stretched. Over the last year it has been stretched this much 2 other times and both the times price has retreated. The first retreat was from August 2022 to October 2022 (about 12 weeks) when it fell -21%. The second retreat was from early February 2023 to middle of March 2023 (about 6 weeks) when it fell -7%. There is a gap above at 359.93 which is +1.53% above current level. This gap is old from April 2022 and price has tried to fill this gap now for 9 trading days and failed. There are 2 unfilled gaps below with the latest one from last week of May this year. This one is at 332.91 which is -6.32% below current level. There is a chance that price fills the overhead gap first. There is a better chance that it goes down and eventually (perhaps over the next 4-6 weeks) closes the gap below. I am short.

IWM: The MACD histogram had reached the highest in 3 months when it retreated last Friday. So, is it going to turn down now? There is a resistance band around the 188 level from around where it retreated having reached 187.77 at Wednesday high. There is a good possibility that price is only taking a breather and goes back up again and breaks through the 188 level. There is a recent unfilled gap below at 176.24 which is -4.75% below current level.

DIA: Price has gone up 4 days in a row and trending bullish. There was a gap above at 340.26 which just got closed Friday before price retreated and closed at 339.27. That is a good sign. There is a resistance band around the 342 level though. There are also 2 recent price gaps below. The first gap below is at 331.98 which is -2.15% below current level.