Week 22 Thursday Morning

Two things happened yesterday:

The Fed signaled a “skip” from raising rates at their next meeting despite strong economic data.

The debt ceiling issue got resolved although some formalities remain.

T do not know what the above 2 does to the markets the next 2 days of the week. My thinking is the focus is back on economic data and Fed policy. The debt ceiling issue was a foregone conclusion.

The QQQ continues to hold on to its gains while the other markets slipped a little bit in the 2 days of trading we have had this week.

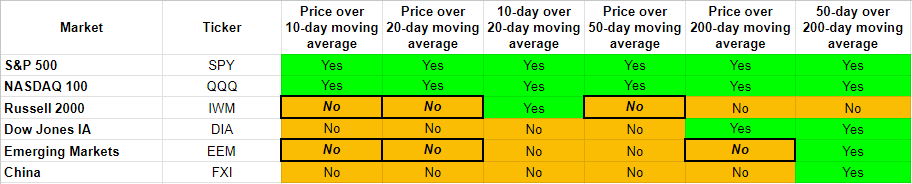

Major Markets Trending

The IWM and EEM deteriorated while the DIA and FXI remained short-term bearish. The SPY and QQQ maintained their perfectly bullish trending.

Expected Moves Update

We can see that all the major markets are down for this week so far. The EEM has already overshot it’s expected range to the downside and FXI is quite close. Note that the expected range is based on the distribution curve and the probability of price staying within that range is 68%.

Chart Observations

SPY: Price is not overbought nor oversold. My expectation is that it will move as the tech stocks move. And with the QQQ very much still overbought, I think the risk remains to the downside. I am positioned short as of now.

QQQ: Price took a small break yesterday. It still looks overbought. I am positioned short as of now.

SMH: The SMH has been overbought after 3 days of huge gains with gaps. It was down yesterday and, in fact, created a small gap above as it went down. However, while NVDA filled its first gap below, SMH has yet to do that. That gap is at 141.14 which is -2.21% below current level. I am positioned short as of now.

DIA: I was surprised to read somewhere that DIA has only been up 5 trading days out of 22 in the month of May. Makes sense as we can see the trending is very bearish. The interesting thing is that the MACD histogram is improving as the price has kept going down. That could also be because it was too extended. There could be a small bounce. In any case, I am positioned short for now.

IWM: Not much to say other than it continues to trend bearish. There is a gap below at 171.56 which is at -1.27% below current level. There is a gap above which looks too far out of sight at this time. I am positioned short.

EEM: Yesterday’s move down was with an unfilled gap above (at 38.44 which is +0.65% above current level). But there is also an unfilled gap below (at 37.83 which is -0.94% below current level). With the right amount of volatility, both can get closed on the same day. I am positioned short for now.

Note that while I am positioned short the markets as of now, I am very nimble and close my positions immediately as I see conditions change. I will not be stuck on my positioning.