Week 21 Trade Candidates at start of week

So far, from my weekend assessments, the trade candidates are:

Long: XLB, XBI, ARKG, ARKK, PYPL, META

Short: XLU, XLRE, KWEB, TSLA, META, IYR

Current Long Holdings: GLD, GDX, SLV, VIX (as a hedge)

Current Short Holdings: IWM, SPY, QQQ, KRE, XRT

SPY: The price is trending perfectly bullish of course. There is a gap above which I expected to be filled last week but did not. This is at +0.60% above current level. There are 2 unfilled gaps below. I am positioned short with a small position.

IWM: The price has been rising and trying to touch the 150-day moving average above. It could do that in the short-term so I should probably take my short trade off. However, if the other markets go down then I believe IWM will also go down.

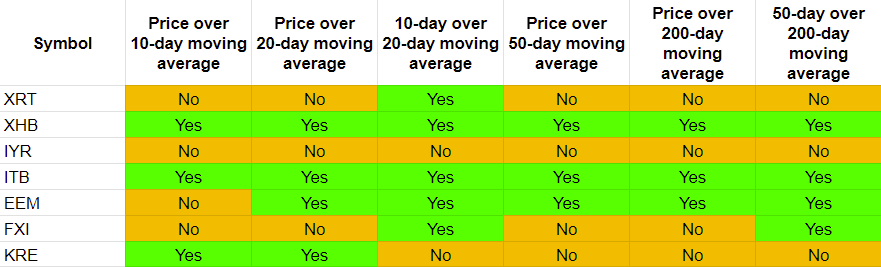

Other Potential Tradable

The above table represents the instruments that I have not covered over the weekend but are potentially tradable.

Chart Observations

ITB price has climbed precipitously but still does not show up as overbought. It is far above the 150-day moving average so I would expect a touch back sometime. There are 3 unfilled gaps below. I will watch for weakness and trade the downside if I get an opportunity.

XHB price has moved similar to the ITB but is now sitting at a resistance level. It is far away above the 150-day moving average and there are 3 unfilled gaps below. I will watch for weakness and trade the downside if I get an opportunity.

EEM price is at the upper end of a wedge formation, so we have to see which direction price breaks out. The price formation does look like a bottoming out. So, there is a good chance for price to go up from here. Watch.

FXI price is trying to bottom out, but it is hard to say if it will be successful. There are too many unfilled gaps in both directions so no point looking at them. No recommendation.

IYR price turned around after bouncing against its 150-day moving average above. Now it looks like ready to fill 1 unfilled gap below which is at -2.17% below current level. This seems like a reasonable candidate to go short.

XRT looks terrible. I am currently short. There is a strong support at -1.14% below current level. I will likely take off my trade at that point. However, if price breaks through that level, then it can get really bad. So, maybe I will take off only half my position.

KRE price has come back up a bit and trying to reverse. But there is a long way to go and if the banking issues are not resolved it can easily have another leg down. I almost feel one should have a downside trade at all times. I do have a small, short position.

Trading Ranges