Week 21 Mid-Week Chart Observations

As you may know I have been positioned short equities and long precious metals for several days now. That positioning has not worked well so far. Yesterday’s market moves erased quite a bit of the losses thanks to some nifty money management that I am proud of. But that is history. Where do we go from here is all that matters.

Yesterday evening, I looked at the trending updates and found some weakness developing in most markets. Today I will review some charts and see what moves can be made for the rest of the week and going forward.

Summary

It was very hard to find anything to play to the upside in the short-term.

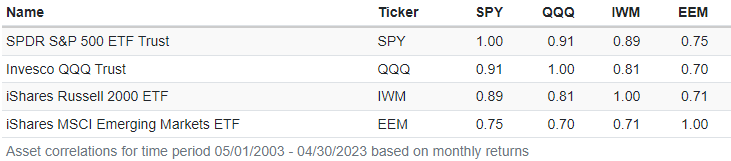

Short Trade Plan: SPY, QQQ, EEM, IWM

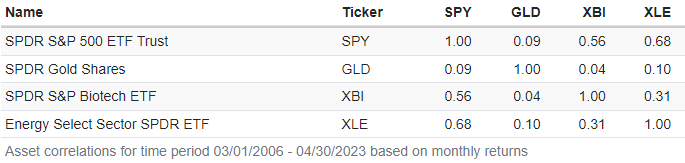

Long Trade Plan: XLE, XBI, GLD, VIX

So, in the end I did find some long trades that I can potentially make. Here is the correlation with SPY:

For the short trades, here is the correlation:

Fairly well correlated. It is more to trade a basket than anything else.

Major Markets Chart Observations

QQQ: Many people look at a resistance or support level as just a level. But it is more of a band, a range than just a level. The price hit that “band” of resistance for a few days and retreated yesterday. So, the resistance did work. Note that the trending in still perfectly bullish. So, any trade will need to be a small and quick one. And the trade could be in either direction.

SPX: The price movement was not able to fill the gap at 4218. It went as close to it as 4212.9 and then failed. That means that gap is still up for grabs. The price dipped below its 10-day moving average. But we know that is not yet a trend reversal. The price closed at 4145 which is right in the middle of the 4048-4212 range that it has been trading since March. There are also 2 gaps below with the first one at -1.50% below current levels. So, I am going to trade SPY for more move to the downside.

If SPY goes down, QQQ will also go down. And QQQ may go down harder given the gains it has had this year. So, I am also going to trade QQQ to the downside.

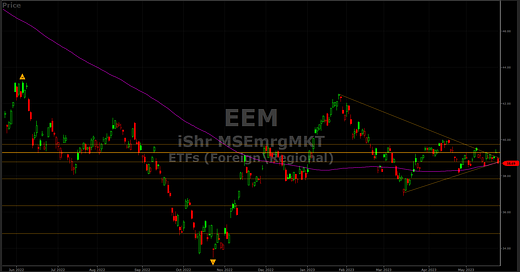

EEM: Price gapped up Monday and then gapped down yesterday. It was trying to come out of the wedge and at first looked like breaking to the upside on Monday. But yesterday it went below the lower trendline of the wedge and now looks like heading down. The trending has turned short-term bearish as well. I will trade this to the downside. Here is the chart:

The chart looks busy because of all the unfilled gaps below.

FXI: Trending is reversing to the bearish side. Nothing much to say other than just trade to the downside.

IWM: This is interesting as it is trending bullish and has been the strongest over the last few trading days. Yesterday the price touched the 150-day moving average which also happened to be a strong resistance and then retreated. Here is the chart:

I cannot see how this also stays positive. So, I will trade to the downside.

Sector, Industries, Commodities Chart Observations

Note that I will not be trading XLC, XLK and XLY because I intend to trade the QQQ/SPY already.

ITB: It has fallen hard 3 days in a row and created an unfilled gap yesterday. It will likely continue falling but may fill the gap above first. I will wait for that and likely play to the downside. But not yet.

XLP: It filled the first gap below and heading fast the next one. But price did touch and stop at the 150-day moving average. So, perhaps a sympathy trade to the upside first.

XLE: It can play an upside hedge against al the shorts I will be trading. The price action has been good over the last few trading days. It is not yet trending bullish. But with price of oil going up, this can catch a break.

XRT: I am short and will remain short for now.

XBI: Still looks good. I will trade to the upside with any weakness. There are no gaps in the chart. It could bounce a bit around the 150-day moving average and there is also a resistance about +5% above current levels. So, will watch for that.

SMH: After a nice run it is falling. If it were an equal weight ETF it would be so much better. But NVDA is 15% and TSM is 11% which makes it very dependent on what those 2 do. No trade. Although I do think it is going down. But I will already capture in QQQ and SPY.

UUP: The dollar strength continues, and it is trending short-term bullish. I am not going to trade it but this strength is affecting my long-term trade in GLD.

GLD/GDX/SLV: These have had a very poor run. They continue to trend poorly. I have long-term calls as hedge against the equity markets. I will continue to hold for now.

VIX: It has climbed from 16.05 to 18.53 in 3 trading days. That may not seem like much, but it is up +15.45% in 3 trading days. I have a long position as a hedge.