Week 20 Technology Trending and Performance

Summary

Most tech sectors look overbought including the NASDAQ 100 (QQQ). We also saw how the XLK, XLC and XLY look overbought when I covered the SPX sectors yesterday. The overall trending though is still improving to the bullish side except for KWEB (China Internet) which has other dynamics in play. I identified KWEB and QQQ as shortlist for short trades and XBI, ARKG and ARKK as shortlist for long trades.

Trending Heat Map (ETFs)

The trending again improved this week from the prior week. We are having this frequent trend reversals because prices are moving mostly in a range bound band. While the trending is strongly bullish for the most part, the market is not able to decide the next thing whether prices should go higher or lower from here. Somewhere down the line this tension will subside, and we will have clarity. Until then, trading has to be within this small band.

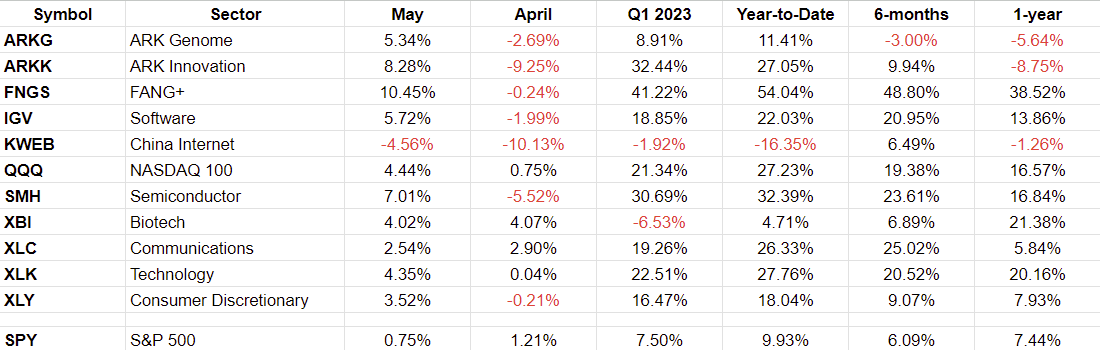

Performance

All of them look very good after a somewhat lukewarm April. The FNGS which reflects the top 10 big tech stocks continue to look the best. I stopped trading big tech after Q1 expecting a weakness with them after such a great run in such a short period. But I have been wrong about them and should have played along with the trend. Lesson learned. I have been playing the KWEB to the downside and that trade has worked out well.

Chart Observations

FNGS: Very much overbought and has several unfilled gaps below. The RSI and BB are indicating overbought levels. Recommend Hold or Sell and/or sell upside calls. Note that FNGS is a close to equal weight of 10 tech stocks. The current allocations are:

In another note I will cover these stocks in greater detail.

QQQ: Has been very bullish and currently maintains it bullish trending. The RSI and BB are indicating overbought levels though. There is a small unfilled gap which is -8.35% below current levels. Recommend Hold or Sell and/or sell upside calls. Note that I am currently short the QQQ.

IGV: The RSI and BB are indicating overbought levels. There are 2 small unfilled gaps below with the first one -2.22% below current level and the second one -18.57% below current level. Recommend Hold or Sell.

SMH: The trending remains bullish with the 150-day moving average curling nicely from a bearish to bullish reversal. The RSI and BB is indicating overbought levels. There are 3 unfilled gaps below with the first one -2.54% below current level. Recommend Hold or Sell and/or sell upside calls.

XBI: This one is interesting as it has had a better bottoming out in its bearish to bullish reversal. The RSI and BB are at OK levels. There are no gaps that I found. The price has been hovering around its 150-day moving average and there is a potential for it to touch back that level again which means some weakness in the very short-term. I have a speculative long position as of now. No recommendations for folks who do not already have a position.

ARKG: This one also has had a good bottoming exercise around the 150-day moving average and seems to be completing a bearish to bullish reversal. It just turned short-term bullish per my system. The RSI and BB levels are OK. There are no unfilled gaps. I will have to check how it is different from XBI. I will place it in my shortlist for a short trade.

ARKK: It also has a nice bottoming bearish to bullish look to it. The RSI and BB are at OK levels. There are 2 unfilled gaps below that bother me a bit. One is at -7.31% below current level and the other is at -18.26% below current level. There is also an unfilled gap above at +71.96% above current level. I will place it in my shortlist for a long trade.

KWEB: It has been a good trade to the short side for me over the last several weeks. It continues to trade poorly and remains bearish. The RSI and BB are not yet indicating oversold conditions. There is an unfilled gap above. But there are 4 unfilled gaps below and that is where price seems to be heading. The first gap below is at -4.85% below current level and the next one is at -14.51% below current level. I have it in my shortlist for trade to the short side.

So, I end up with:

KWEB and QQQ on my shortlist for trade to the short side.

XBI, ARKG and ARKK on my shortlist for trade to the long side.

Expected Price Range

Note these are all expected moves through next trading week ending May 26 Friday.