Week 20 Commodities Trending and Performance

Summary

The precious metals have traded very poorly over the last week or so and that is reflected in their trending. I am still holding my long positions in GLD, GDX and SLV but do not know how long I can continue to do so.

Other than the precious metals which I need to watch closely, COPX and UNG seem like can be traded to the long side.

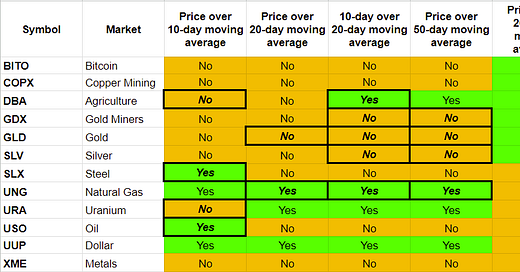

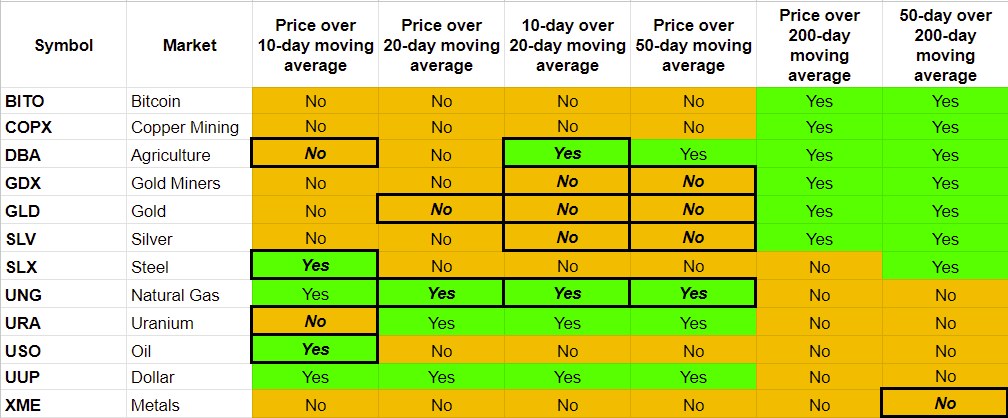

Trending Heat Map

We can see the weakening of the precious metals. Also, XME is doing poorly. Meanwhile, UNG (US Natural Gas) could be finally strengthening but I still think it is too early to say. Overall, the commodities are weak perhaps in response to the dollar being strong. But we may be seeing the strength of the dollar slowing down which could bid up commodities. A lot of ifs in there. Maybe we just have to wait and watch.

Performance

May weakness is evident except for UNG which is up big. If it can maintain this, it will be 2 months in a row that it will have gains. After what has been a horrendous year.

There is still for precious metals to come back in May. Will it do that? Perhaps the chart will give me some idea.

Chart Observations

BITO - do not want to analyze using this instrument as Bitcoin is traded 24x7 so gaps in BITO are meaningless.

SLV price is between an unfilled gap above and an unfilled gap below. Which will it close first is the question. I have a long trade that I will need to close out and take the L if it falls from here. The long-term trend is still bullish. So, we shall see.

GDX price has 2 unfilled gaps above and 2 unfilled gaps below. The long-term trend is still bullish. I hold long position and will have to decide soon whether I can continue to hold them.

GLD price has 1 unfilled gap above and 5 unfilled gaps below!!! The long-term trending remains bullish. I hold long position and will have to decide soon whether to hold or liquidate.

UUP price is doing a classic bullish to bearish reversal even though the short-term trending is bullish. It looks like that is a short-term phenomenon. There are 5 unfilled gaps below and 2 unfilled gaps above. At this time, I am banking on the long-term trend to continue to the bearish side which means precious metals should rally.

USO price continues to make a bullish to bearish reversal. The tide may be turning as the 150-day moving average is slowly flattening. There is 1 unfilled gap below and 2 unfilled gaps above.

COPX could be a candidate for a bullish trade. The 150-day moving average is indicating a bullish trend (confirmed by the long-term trend above being bullish) and the price has checked back to the 150-day. There are 2 unfilled gaps above and 3 unfilled gaps below. I think there is a good chance the first unfilled gap above (which is +4.73% above current level) gets filled first.

UNG price is trying to claw back to its 150-day moving average level. There are 5 unfilled gaps above. It is at 7.46 and in 3 months could be at the 10 level. I make it a candidate for a long trade.

XME there is nothing to say and nothing to do other than watch what happens next.

Expected Move Range

UNG has high expectations.