Week 17 Market Notes

I have been taking a brief vacation and have not been writing here regularly. But markets never stop. So, here are notes on trends and performance.

Major Markets Trending

One day (yesterday trading) has made a difference especially to the S&P 500 and the Dow Jones. The NASDAQ and QQQ were already showing some signs of weakness before yesterday. And the Russell 2000 has been perfectly bearish for a few days.

I remain short IWM, SPY and QQQ.

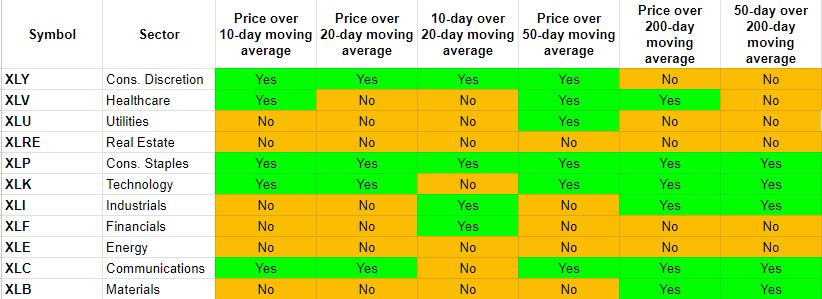

SPX Sectors Trending

Many more amber cells this time with XLRE and XLE perfectly bearish while XLP turned perfectly bullish. This would be expected in defensive markets.

I am currently short XLK.

Commodities

Precious metals seem to be coming back up a bit - certainly yesterday was a big move up. Overall, the commodities not doing too well though. I track the US Dollar here which seems to be doing OK being short-term bullish now.

I remain long GLD, GDX and SLV.

Technology

Looking at the picture it is clear that the Big Tech (FANG+) is holding up the entire technology sector. The distress in others can be seen in all the other ETFs. The XLC, XLK and the XLY are also propped up by the Big Tech names.

I remain short XLK and KWEB.

Overall, my modeling tells me that the market risk is to the downside. Accordingly, for the foreseeable future, I will pay equities short and precious metals long.