Week 17 Financials Trending and Performance

The first day of trading was quite lukewarm. As I write this First Republic Bank declared their quarterly earnings. They beat on earnings and revenues but also declared a drop of -40% of their deposits from prior quarter. The stock is down around -7% after market. I am short the KRE, and this would be an indication of how the regional and small banks could have fared the last quarter. Although, I would say that we will likely not see the full impact as the bank issues happened in the middle of the quarter.

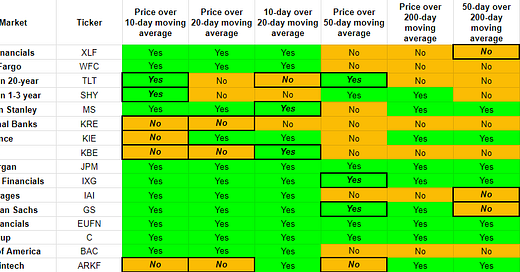

Trending Heat Map

Several changes in the trending and, overall, it seems to be even between green and amber. Important to note that XLF turned long-term bearish even though it is trending bullish short-term. That could just be a tail effect, so I am not going to pay too much attention to it for now.

The KRE has turned short-term bearish again. Note that the price and the short-term moving averages have been bunched up for a while. So, the directional situation can change quickly. I am short KRE.

The KBE also is not doing well. And ARKF also seems to be breaking down. In the good news area JPM and C remain perfectly bullish.

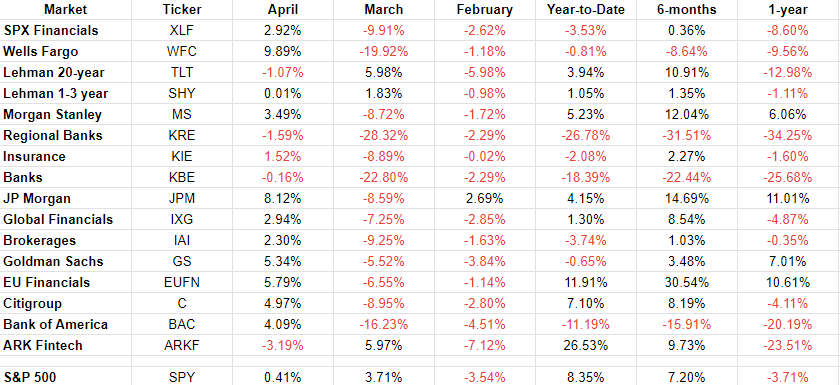

Performance

April so far has been reasonably good. The big banks have been strong post their quarterly earnings release. Only 5 out of the 16 I track are negative. For the year, the KRE and KBE both remain very negative. They have been consistently negative over all periods.

There is a lot to watch on the financials going forward through this year and next. The deposit situation in the small and regional banks, the net margin income which may be under pressure, the potential credit crunch and the potential commercial office property defaults. My sense is that financials will need to be traded and not invested in at least for the near future.