Week 16 Financials Trending and Performance

Summary

The banks are trying to make a comeback with the big banks taking the lead. As I write this, the story of Apple offering high interest-bearing savings accounts has broken. Too early to say what impact it has but will be interesting for sure. The trending has improved in general. However, I remain short the KRE.

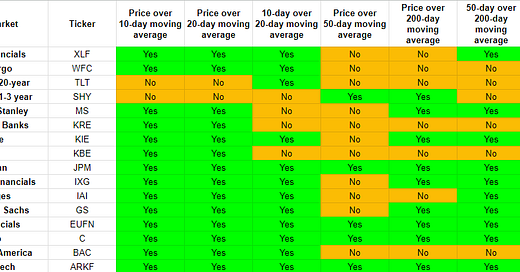

Trending Heat Map

The Financials sector XLF is trending good and actually got better over last week. This is of course led by the big banks which went up big last Friday earnings releases. However, both KBE (Bank Index) and KRE (Regional Bank index) have not exactly turned bullish per my model.

The price for both has crossed over their 10-day and 20-day moving averages showing some level of strength. The KBE was up +2.27% and the KRE was up +2.98% today. That is a strong effort and could lead them to turn bullish. It seems all depends on what is said in the regional banks’ earnings calls.

Among the big banks JPM and C are trending perfectly bullish per my model. The others are not too far behind. State Street STT (I do not track it here) fell -9% after earnings release. Whereas M&T Bank MTB (I do not track it here) rose +7% after earnings.

Performance

Past performance is not an indicator of future performance. However, when combined with good trending, trades will likely deliver the expected results or close to that. It is not a revelation that JPM is the best individual bank stock to invest in. I do not invest in individual stocks and favor the ETFs instead.

March was a horrible month for the banks in general as seen by the returns for KBE -22.80% and KRE -28.32%. In the month of April, they have tried to come back and so far, are positive with couple of weeks to go in the month. As mentioned earlier, the big banks seem to be OK. The smaller regional banks are still a question mark.

I am still short the KRE which is the ETF for the regional banks.

Here is a 3-year chart for KRE for some perspective.

When the price dropped in March, it filled couple of price gaps from more than 2 years back. It also has created a recent unfilled gap on the way down. We can see the congestion in the 42-45 level where price has hovered for a while now. The probability for downside seems higher to me right now than to the upside.