Week 15 Mid-Week Markets Check-in

It has been 3 days of trading this week and it is time to heck-in on the trending changes, if any. There are big “news” items of course this week. We had one yesterday and there are a few more before the week is over. But we care only about price movement and what the markets are telling us.

Summary

Technology which has been the leader so far is now taking a back seat. Energy could be the new leader to take the markets higher. However, the markets are showing some minor weakness which may mean that the strength in energy may not be enough. My models tell me that the risk for equities is to the downside.

Precious metals and related continue to do well.

Major Markets Trending

The S&P 500 has no change in trending.

The QQQ price dipped below its 10-day moving average.

The NASDAQ price dipped below its 10-day moving average.

The Russell 2000 price crossed over its 20-day moving average. (Note that after Tuesday close the price had turned short-term bullish meaning price had crossed over the 10-day as well. But after yesterday’s down day the price has given back some).

The Dow Jones has no change in trending.

SPX Sectors Trending

XLY price dipped below its 20-day moving average.

XLP turned perfectly bullish.

XLK price dipped below its 10-day moving average.

XLI turned short-term bullish.

XLC price dipped below its 10-day moving average.

XLB turned perfectly bullish.

Financials Trending

WFC turned short-term bullish.

SHY turned short-term bearish.

KIE price crossed over its 200-day moving average.

JPM price crossed over its 20-day moving average and the 10-day also crossed over the 20-day moving average.

IAI turned short-term bullish.

EUFN turned perfectly bullish.

BAC turned short-term bullish.

Technology Trending

We can see the amber color in most of the first 2 columns indicating recent weakness. The only ones still looking strong are the Bitcoin/Crypto related ETFs.

Energy Trending

Mostly looking good.

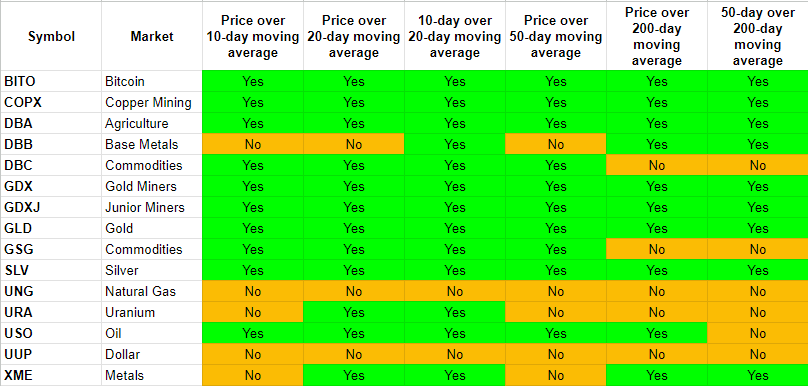

Commodities

Precious metals continue to trend bullish.

My Positioning

Currently I am mostly positioned short equities through put options on the SPY, QQQ, IWM and KRE. I am long the precious metals (GLD, GDX, GDXJ and SLV) and energy (XLE).