Week 14 Commodities Trending and Performance

Commodities could turn out to be a big play in 2023 and beyond. Several factors such as risks of recession, inflation, etc. could impact commodities and open up trading opportunities. I have been trading the precious metals and looking at other items as well.

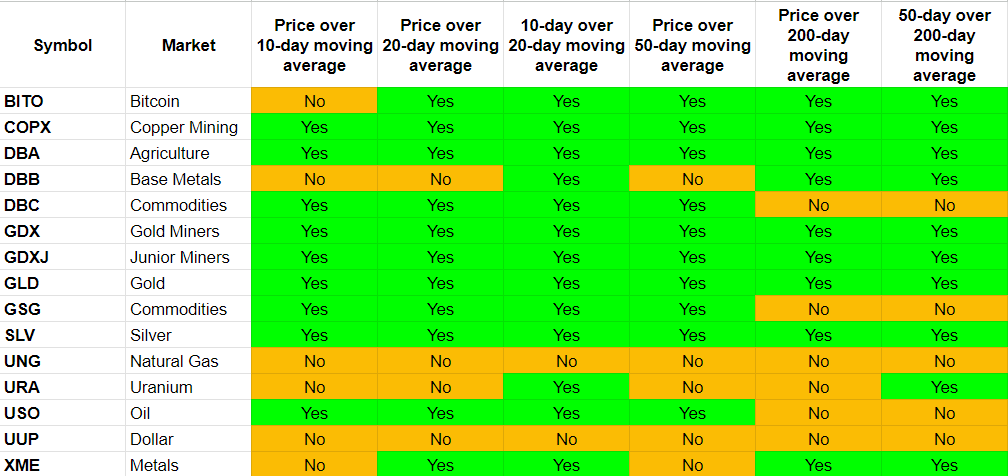

Trending Heat Map

BITO price dipped below its 10-day moving average. It seems the Bitcoin price is stuck around 28k and cannot break that level.

COPX remains perfectly bullish.

DBA turned perfectly bullish.

DBB price dipped below its 10-day and 20-day moving averages.

DBC price turned short-term bullish, and price also crossed over its 50-day moving average.

GDX remains perfectly bullish. (I am long GDX through calls and also GDXU).

GDXJ remains perfectly bullish.

GLD turned back to perfectly bullish.

GSG turned short-term bullish, and the price crossed over its 50-day moving average.

SLV remains perfectly bullish.

UNG remains perfectly bearish.

URA price dipped below its 10-day and 20-day moving averages.

USO turned short-term bullish, and the price crossed over its 50-day moving average.

UUP remains perfectly bearish.

XME price dipped below its 10-day moving average.

Performance

The precious metals have been on a strong run and continue to remain perfectly bullish. One wonders how long this run can go on. However, this is one I will keep playing until the trend reverses. It has been a very good trade so far.

For GLD to be up +10% in 1-month is something. I am sure it has happened before but certainly unlikely in the recent past.

Week-over-Week Performance

So, GDX, GDXJ and SLV are up 4 weeks in a row now. We can expect a dip coming soon. But if the trending remains intact, that dip may be an opportunity to buy more. The GLD also is up 5 out of the last 6 weeks.

My positioning will remain long the precious metals and related (GLD, GDX, GDXJ and SLV) for the near future.