Week 13 SPX Sectors Trending and Performance

Trending Heat Map

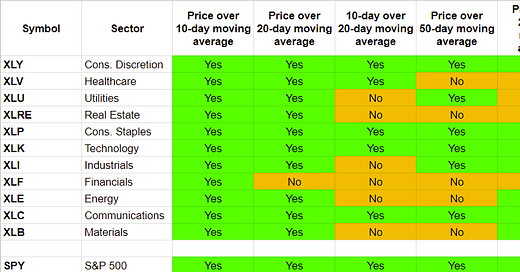

We can see that the broader index S&P 500 (SPY above) is overperforming 9 of the 11 sectors from a trending perspective. Technology XLK and Communications XLC are the ones driving the S&P 500. This is not necessarily bad as the rest of the sectors can pick up the pace soon. Certainly, they are showing the tendency to do so as their trending have been improving.

The risk is that traders and investors start taking profits on their gains in the Technology and Communication sectors and bring the rest of the markets down. But until the trending reverses, we should be going with the flow.

Performance

March was mixed with 6 sectors positive out of 11. February was bad for all sectors. There is no real pattern, but we can see that Technology XLK, Communications XLC and Consumer Discretionary XLY have been the leaders this year so far. The XLY is misleading by its name as it has Amazon and Tesla as its components.

I show the S&P 500 (SPY) to check how the sectors are doing in comparison to the broad index. Year-to-date the SPY has done better than 8 of the 11 sectors.

Week-over-Week Performance

All 11 sectors were up this week. The XLY, XLV, XLP, XLK and XLC sectors are up 3 weeks in a row. From a mean reversion perspective, it is time for a down week. But that is not a strategy to rely on. I want to review some of the charts.

XLK

I do not like how far the price has gone above the 150-day moving average. I also see the resistance bar looming above (shown in red). I would say there is a higher probability for price to give back some next week.

XLC

The price seems to be going through a bottoming exercise around the 150-day moving average. However, it does look like the price may check back to the 150-day before continuing its journey up.

XLY

I do not like the setup even though the price moved up with strong momentum the last trading day.

XLE

The price is up 6 days in a row. The 150-day curling indicates a bullish to bearish reversal. There is also an unfilled gap below. So, I do not like the setup.

My Positioning

I have been “offside” a bit over the last week. That means I have been playing against the trend which was trending bullish. I still have shorts on which I think may work out next week. But after that, the trending will decide what I do.