Week 13 Financial ETFs Trending and Performance

I have expanded on the financial ETFs that I track. Having this wider spectrum under observation will allow for directional as well as pair trades going forward.

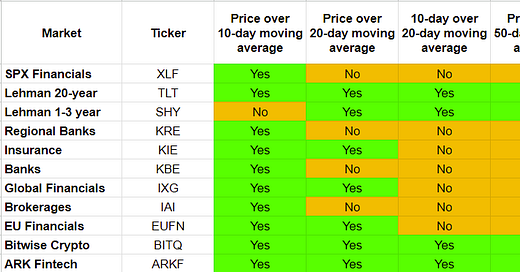

Trending Heat Map

The banks continue to lag behind within the financials as well as the wider markets. I am still short the KRE, and it has been a good trade so far. The “tech enabled” finance seems to be trending well with ARKF trending perfectly bullish and BITQ close to perfect. Yields have been coming lower, so TLT and SHY are doing reasonably well.

Performance

Clearly KRE and KBE have been the big trades in March. Looking at the trending, they have not yet recovered. As seen in the trending heat map, the “tech enabled” financials have done well in March as well. BITQ is up +73% YTD due to the crypto market’s resurgence.

Week-over-Week Performance

What jumps out is that KRE is down 6 weeks in a row. And TLT is up 6 weeks in a row. ARKF has delivered +32% year-to-date. However, it is up one week and down the next. So, if the pattern continues, the next week should be down. Given its YTD gains, there could be some mean reversion at play as well.

I want to review some charts.

XLF

I stretched out the chart timeline to show that the downward trending of price hit the pre-covid high and then bounced back somewhat. The price did the same in June and October of 2022 as well. So, that is 3 times it has done that now and bounced back. I do not see that as a real bounce and think that the probability price breaks that level to the downside is higher this time.

KRE

There are 2 unfilled gaps - one above and one below - which need to be filled at some point in time. Note that with this massive downward price action 2 other long-standing gaps (shown in yellow) got filled. There is a higher probability that the price is just taking a breather before it continues its downward move.

BITQ

To me this looks like a nice slow bottoming exercise. Strange to say slow for BITQ which has been so volatile. But the chart puts things in perspective and shows that it has not been as volatile as one might think. I am tempted to play this to the upside for a continued bounce above the 150-day moving average. Here are the Top 10 holdings within BITQ (from Seeking Alpha):

ARKF

Nice bottoming price trend similar to BITQ is seen here as well. Here are the Top 10 holdings within ARKF (from Seeking Alpha):

My Positioning

I continue to hold KRE shorts and am thinking of converting that into a pairs trade by playing ARKF and BITQ on the long side. Although, I would probably wait as there could be a minor bounce-back in KRE and a small give-back in ARKF/BITQ first.