Week 12 SPX Sectors Trending and Performance

It is clear there is divergence among sectors within the markets. The Technology XLK and Communications XLC sectors have been trending perfectly bullish for couple of weeks now. The Consumer Staples XLP seems to also be trending bullish now. Among the laggards are XLY, XLRE, XLI, XLF and XLE.

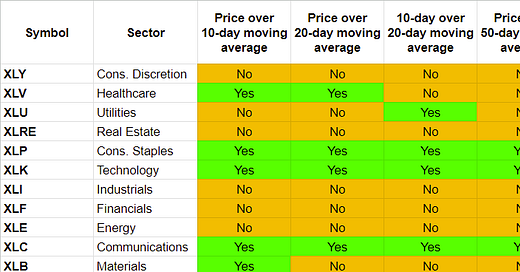

Trending Heat Map

XLY price dipped below its 10-day moving average and is now trending perfectly bearish.

XLV price crossed over its 10-day and 20-day moving averages.

XLU no change.

XLRE remains perfectly bearish.

XLP turned short-term bullish.

XLK remains perfectly bullish.

XLI no change.

XLF no change.

XLE no change.

XLC remains perfectly bullish.

XLB price crossed over its 10-day moving average.

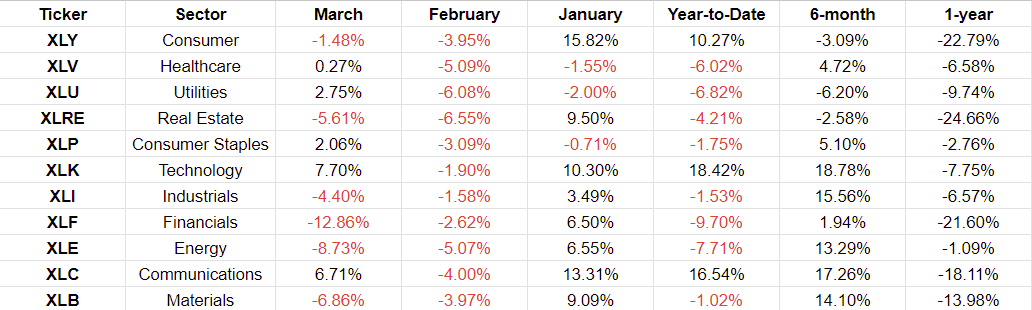

Performance

The trending divergence is proved by the performance divergence this year. January was mostly up; February was universally down, and March-to-date is mostly down. We only have XLY, XLK and XLC that are up for 2023 as of now.

Week-over-Week Performance

We have had 2 reasonably good weeks for most of the sectors. Financials are among the worst hit for obvious reasons. So, the question is whether they bring the rest of the markets down or whether the technology and communications will bootstrap the other sectors up.

I am positioned slightly bearish with the stock markets and hedging that with precious metals for now. If the situation changes, I will change with it.