Week 10 mid-week Trending updates

I feel compelled to review the trending after just 2 trading days this week. The markets could be getting more volatile than they have been in the recent past. That does not mean the VIX is elevated - it is still under 20. It just means that we may have some see-saw movements the rest of this week and potentially beyond.

With today’s price action in the markets, the trending has most certainly weakened. I do not think too many pundits will be talking about a bull run soon. I am positioned on the short side holding puts and holding them for now.

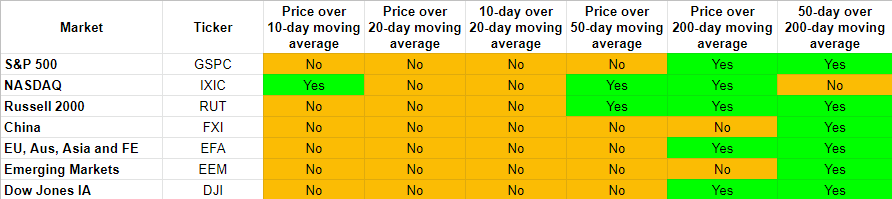

Major Markets Trending Heat Map

S&P 500 price dipped below its 10-day and 50-day moving averages.

NASDAQ - no change.

Russell 2000 price dipped below its 10-day and 20-day moving averages.

China FXI price dipped below its 10-day and 200-day moving averages.

EAFE price dipped below its 10-day, 20-day and 50-day moving averages.

Emerging Markets price dipped below its 10-day and 200-day moving averages.

Dow Jones price dipped below its 10-day moving average.

SPX Sectors Trending Heat Map

XLY price dipped below its 10-day moving average.

XLV price dipped below its 10-day moving average.

XLU price dipped below its 10-day moving average and it turned perfectly bearish.

XLRE price dipped below its 10-day moving average and it turned perfectly bearish.

XLP - no change.

XLK price dipped below its 20-day moving average.

XLI - no change

XLF price dipped below its 10-day and 50-day moving averages.

XLE price dipped below its 20-day moving average.

XLC - no change.

XLB price dipped below its 10-day, 20-day and 50-day moving averages.