Week 10 Major Markets Trending and Performance

Just a little bit about my process in today’s note. No intent to brag but just wanted to share how I stay calm no matter what happens in the markets. It is a question I get often. Let us look at the trending and then we can discuss some more.

Trending Heat Map

The picture tells the story. There is nothing much to say other than markets go around in cycles. This bear situation will also not last and there will be opportunities to get back in the markets for those who are sitting in cash.

I am aggressive and play both sides of the market using simple call or put options. I use my defined trending heat map (above picture) every week to define my actions and stay disciplined to it.

I only trade indexes and ETFs because they offer me risk mitigation from the vagaries of individual stocks. This risk mitigation combined with the leveraged play using options is keeping me happy. I do not need to talk about exciting and interesting stocks of innovative companies as the experts and punts on TV do. I just want to make money.

The trending heat map is something I review and update at least twice a week. Sometimes every day just to stay on top of volatile markets. It tells me the current trending of the markets but also the pattern of the trending. Right now, over the last several months, we have seen a rolling pattern of trends in the markets.

As an illustration, here is the trending heat map from last week (week 9):

And here is the trending heat map from week 8:

Ae can see that the markets were trending long-term waning bullish in week 8 and then week 9 did make a good comeback to show short-term strength the following week. In week 10 we lost that momentum and are somewhat back to where we were at week 8 (and a little worse actually).

So, the momentum is certainly to the downside as of now. I do not try and predict whether it will continue to go down from here or now. I play the probabilities which tells me that the odds of lower are better. Markets never go up or down in a straight line. So, I will not be surprised if there is a small bounce back first.

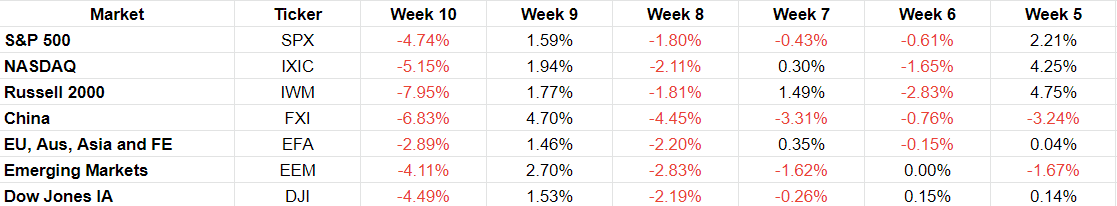

Week-over-Week Performance

The Russell 2000 is the broadest market from among the above and it was down the most. So, markets most definitely took it on the chin, and it does not look good for the near future.

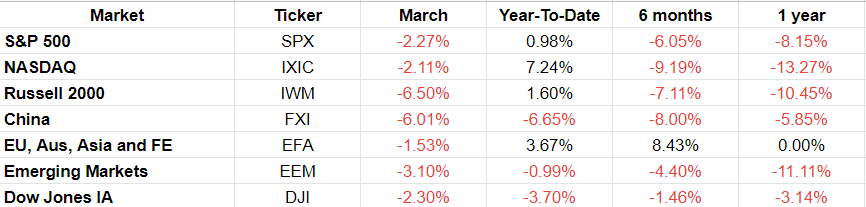

Performance over various periods

More reds than most people would like to see. I wrote once that “buy and hold” is not possible for most people and got a lot of flak for it. But I stand behind that. Not all people can hold on to their investments for 40 years at a time. And even if they can and they do, what if this is the year, they want the money, and the market is down -40%.