Sunday Stock Market Roundup

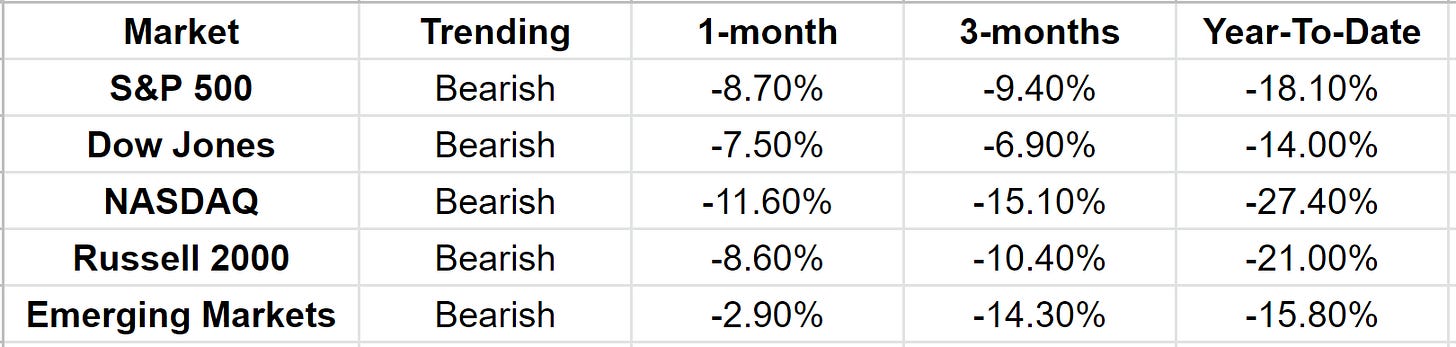

On Friday morning I wrote that most stock markets turned bullish at the close of trading Thursday. However, the Friday session was weak and so I did not get into any more positions. The session was indeed weak in that it started weak and closed even weaker. So, where does that leave us at the end of the week? Here is a summary of the major stock markets:

Observations:

For the week the markets were mixed with S&P 500, Dow Jones and NASDAQ down whereas Russell 2000 and Emerging Markets eked out small gains.

Despite the weakness, all the markets are trending bullish. In fact, NASDAQ moved from “close to bullish” to being actually bullish.

The Russell 2000 and the Emerging Markets continue to lead the markets. They were the ones that had reversed and turned bullish first.

This is how the table looked like on May 23:

We can compare the 2 tables and see that the returns are still negative as it was before. However, the rates have improved.

Sectors Review

Looking at the individual S&P sectors provides more confirmation that the markets have improved:

We can see that 13 out of the 15 sectors that I track are now bullish per my model. That is 3 more than Thursday’s close. That shows that despite a down day on Friday the trends were strong enough to turn those 3 sectors bullish.

As a reminder, my model for calling something bullish is a very simple indicator that has worked for me, and I continue to stick with it. I use the following simple rules for my entries and exits.

When the 10-day SMA crosses over the 20-day SMA I buy

When the 10-day SMA stays above the 20-day SMA I hold, and

When the 10-day SMA crosses below the 20-day SMA I sell

Repeat above steps

These rules will never get me in the market at the bottom. Neither will it get me out of the market at the top. But there is a high probability that it will let me catch most of the bull markets and avoid the bear markets. That sounds good to me.

Current Holdings:

SPXL - 3x leverage of the S&P 500

TQQQ - 3x leverage of the QQQ

XLU - Utilities call options

XLV - Healthcare call options

EEM - Emerging Markets call options

IWM - Russell 2000 call options

XME - Metals call options

SOXL - 3x leverage of Semiconductors call options

Conclusions:

For now, everything that I am seeing tells me that markets are reversing and starting to trend bullish. That does not mean that it is guaranteed to go up from here. It only means that the probability of markets moving higher are more than the markets going lower. I will stay with my positions as long as my model tells me to.

Yes, there is a lot of negativity from experts and commentators that we are looking at a recession and that markets will fall lower. But for me price is the truth and defines the trend. I will stick with that and do what the facts tell me to do. Not the opinions.