Stock Market Undecided

Yesterday, after what seemed like a see-saw battle between the bulls and the bears the S&P 500 ultimately closed slightly negative. The all-time high for the S&P 500 was on Jan 3, 2022, at the beginning of the calendar year.

We are down -3.3% over 1-year trailing and -17.5% down year-to-date as well as from our all-time high. That is quite steep for the S&P 500 and close to full correction territory.

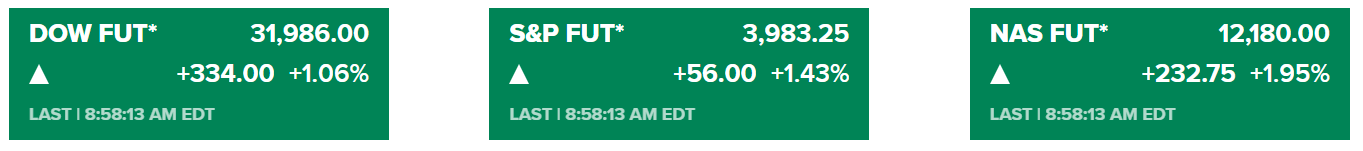

The question really is whether this is the bottom of this bear market, or we have some ways to go. That is hard for me to say as I do not predict the markets. Certainly, as I write this, the futures are all very positive.

We do know though that the market has not stuck with early morning pre-market numbers. So, what matters will be how the markets close today.

In the chart above I have plotted the longer-term simple moving averages for 50-day (purple) and 200-day (red). We can see that the “death-cross”, which happened on March 15, did bring on more selling after initially trying to recover. From the indicators it does seem like a “golden cross” (that is when the 50-day SMA crosses back over the 200-day SMA) is not too near and will take some effort.

I will be first looking for the short-term indicators to align. That means the 10-day SMA crossing over the 20-day SMA. As we saw yesterday, there is still a good amount of gap there. That is when I will be ready to make my move. Until then, I wait and watch.