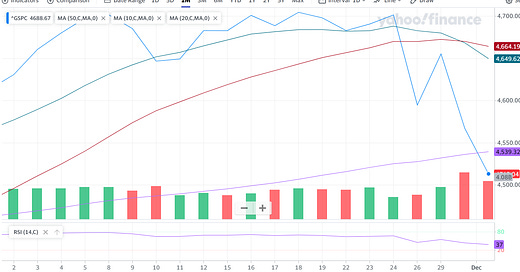

Stock Market Trending Bearish

I sold all my positions over the last 2 days. The stock market has turned bearish per my model. The reason why does not interest me much and I will not ponder over that. The general thought is it is related to the Omicron COVID uncertainties. However, the markets were indicating weakness before that news broke.

Earlier this week I had positions in SPXL, TNA, TQQQ, FNGU and BULZ. I like to go hard when the trend is bullish and so I like to use these leveraged instruments. I am now out of all of them even though the TQQQ had not exactly turned bearish per my model.

So, where do we stand and when will I get back in the markets. I will just follow my defined model. Let’s review the markets starting with the major indices.

The S&P 500 is trending bearish. The 10-day moving average of the price crossed below the 20-day moving average. To me this does not look like the weakness is done. I like to see the 10-day cross back over the 20-day to confirm that the trend has turned bullish again. Until then I will stay away.

What about the other markets?

The Dow Jones is in a similar situation and the chart looks the same - just weaker than the S&P 500. The NASDAQ chart looks very similar to the S&P 500. The Russell 2000 chart looks more like the Dow Jones and strongly bearish at this time. The Emerging Markets (EEM) is the weakest of them all.

So, all the markets are crying out their weakness as seen in their charts. The volatility index VIX is at around 30 which is very high. So, I will stay away for now and watch from the sidelines. I will do a sector analysis later today.