SPX Sectors were mostly weak except for Technology and Communications

Looking at the S&P 500 sectors. Only 2 of the 11 sectors eked out a gain last week. They are the Technology and Communications sectors which have been the laggards in the past.

First the trending heat map.

XLY no change. Continues to trend short-term bullish.

XLV worsened with the price falling below the 10-day and 20-day moving averages.

XLU seems like fell off the cliff. The price fell below the 10-day, 20-day, 50-day and the 200-day moving averages. It seems to be rolling over.

XLRE no change in trending.

XLP price fell below the 10-day and the 200-day moving averages.

XLK no change in trending.

XLI price fell below the 10-day, 20-day and the 50-day moving averages.

XLF showed a slight weakness with price crossing below the 10-day moving average.

XLE remains perfectly bullish. No change.

XLC no change in trending.

XLB continues to trend perfectly bullish.

Let’s see the week-over-week returns of the sectors:

Most sectors were down which is not surprising because we know that S&P 500 was down. Also, the Dow Jones and the Russell 2000 were down. NASDAQ was up and in turn XLK and XLC were up as well.

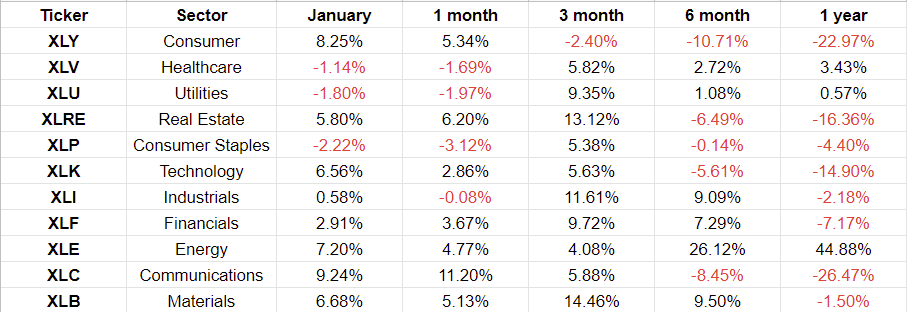

Let’s review the performance over different periods:

We see clear winners and clear losers. On the winners circle we have Real Estate XLRE, Technology XLK, Communications XLC and Materials XLB. Among the losers are Healthcare XLV, Utilities XLU and Consumer Staples XLP.

Observations:

Mimicking the NASDAQ, the technology sector is up 4 weeks in a row. The Communications sector is even better being up 5 weeks in a row.

The Materials sector is doing very well and is one of the few that remained perfectly bullish this week. Energy was the other.

It seemed like Energy had peaked. But recent action suggests the sector could continue to do well.