The Magnificent 7 stocks were all down yesterday except for NVDA.

The leadership came from the other 493 in the S&P 500 (as seen with the RSP going up - the RSP is the equal-weighted S&P 500) and the small caps IWM.

You could call this broadening of the market. Although, I cannot see a continuation of the bull run with just the rest of the markets going up while the Mag7 go down. The IWM was actually up almost +2% during the trading day before giving up most of the gains by the close.

I do not feel confident that the bull run can continue. In fact, the risk is now to the downside.

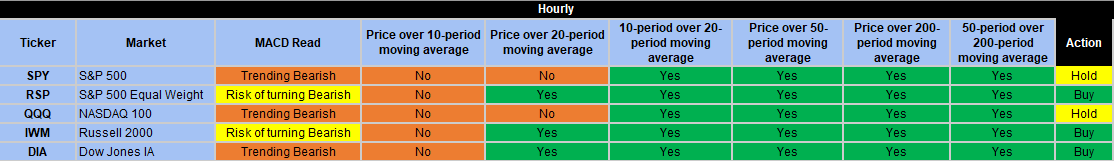

Here is how the short-term trending of the major markets looks like:

This is based on the hourly charts and meant for very short-term purposes. At best it gives an indication of how the markets are trending for the rest of this week. There is not much trending change in the daily charts from the beginning of this week.

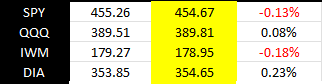

The VIX crept up a little but not enough to cause any concern. The thing to remember is that the markets (SPY and QQQ) have been up 4 weeks in a row and will it make it a 5th week in a row or not. Here are how the returns look like this week so far.

They are more or less flat. It is interesting to see that the QQQ and SPY are the laggards though. Are we going to see any big moves in the remaining 2 trading days this week? I think there is a higher risk of that. And if I had to bet it would be to the downside. But I do not bet. I follow the market.

We are due for a pullback, and I will not be placing new long positions now. If I see the pullback, I will place small short-term bets to the downside. I say small and short-term because I see that we are still in an uptrend if it is a minor pullback. If it is more than that, then the price will tell me, and I will add to the short positions.

Every action is based on what the market tells me to do.