All major markets are up 7 weeks in a row. That does not necessarily mean this week will be a down week. It is always a fallacy to assume or forecast. I would say there is a 50:50 chance either way. In the markets favor is the fact that it is the week just before the holidays. Also, there may not be much of tax loss harvesting this year as most would have accumulated gains on which they will want to defer paying taxes.

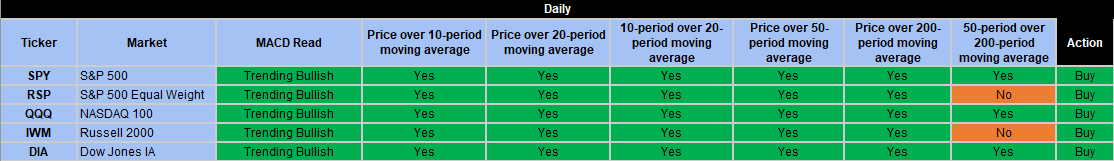

The most important thing is that the trending heat map looks strongly bullish.

The picture looks almost perfect. We did have the SPY, RSP, IWM and DIA retreat on Friday. The QQQ was lower on Thursday and up on Friday. But these movements have not changed the trending much at all.

From the charts we can say that all of the markets look overbought when we look at their MACD and RSI. However, we have seen this happen before. The markets could easily go sideways for several weeks and then the overbought signals diminish, and markets pulls up higher.

All the above to say that there is “expectation” that markets will cool down at least a little after such an elevator move up. When and by how much the markets will fall is the part that is unknown. And until the markets actually tell me when they are ready to take some rest, I am just going to wait.