We have 3.5 days of trading this week and many traders are going to take some time off. So, I expected it to be quiet. Although OpenAI and Microsoft are making some news, and we also have the all-important NVDA earnings release after close Tuesday.

Nonetheless, expected moves for this week are subdued expect for NVDA of course which is expected to move 7.91% in either direction by Friday close.

Here are the expected moves for the ETFs I track with the highest Range % on top.

We can see that SPY is expected to move just about 1.11% in either direction. QQQ is a little better at 1.63% and IWM the best among the major indices at 2%. So, expect a slow week.

Most markets are trending bullish. Here is the daily trending heat map:

And here is the weekly:

So, all things remaining normal, markets should be going higher. All things remaining normal is a misleading statement as all things never remain normal. What I mean is no unexpected risk moves that impact markets adversely. For this week those would be

expansion of the middle East war

NVDA declaring poor results.

some statement/move by OPEC on oil.

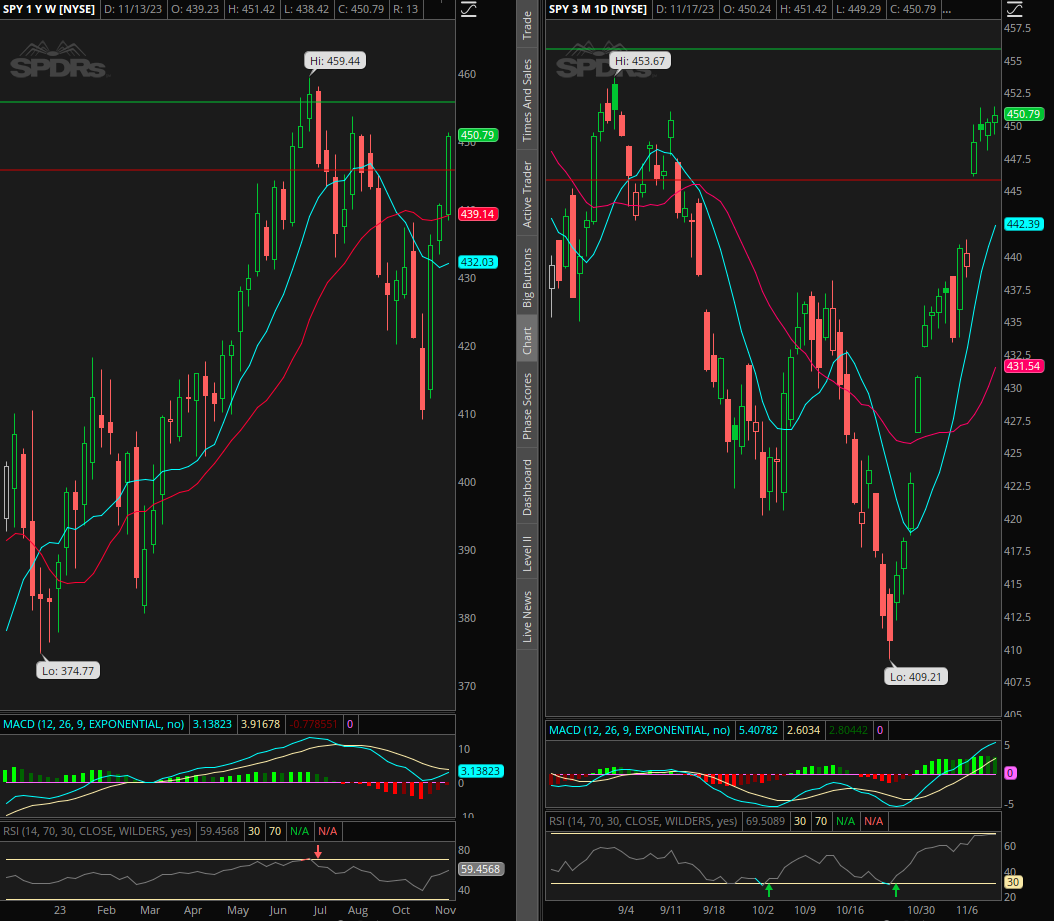

There is another thing that may be drag on markets this week. That can be reflected in the SPY weekly/daily chart below:

We are up 3 weeks in a row. And we are up 13 out of last 15 trading days. So, sheer law of averages could come to play here. Also, we are hitting up against resistance in most markets. Although, price has a way of breaking through resistance at some point, it may not be a straight line. Combine that with a seasonally slow week and markets could drift a little.